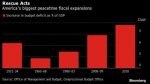

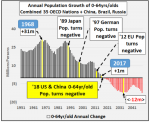

On Saturday, we showed why according to observations from Credit Suisse and BofA, the "US Economy Is Set To Overheat As Households Are Flooded With $2 Trillion In Excess Savings." Then, in a note this morning from Morgan Stanley asking "What To Do About All This Optimism" the bank said that "in November, December and now January, no question or concern has come up more often than ‘everyone is optimistic’." Finally, the latest Fund Managers Survey showed that investors’ global growth expectations rose by 1% to a net 90%, the 3rd highest growth expectations ever (#1 in March 2002, #2 in November 2020).This unbridled optimism prompted Goldman to boost its full year US GDP forecast to 6.6%, nearly 50% higher than the 4.1% consensus.The common theme: record euphoria has gripped not just markets

Read More »