Category Archive: 1) SNB and CHF

2023-12-20 – 4/2023 – Business cycle signals: SNB regional network

Report submitted to the Governing Board of the Swiss National Bank for its quarterly monetary policy assessment The appraisals presented here are based on discussions between the SNB’s delegates for regional economic relations and members of management at companies throughout Switzerland. In its evaluation, the SNB aggregates and interprets the information received. A total of 239 company talks were conducted between 10 October and 28 November.

Read More »

Read More »

SNB’s Jordan: I’m not sure whether if the terminal rate has been reached

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance.

Read More »

Read More »

SNB’s Jordan: Another interest rate move is possible if current monetary policy is not restrictive enough

In an interview with local television station TeleZueri, Swiss National Bank (SNB) Chairman Thomas Jordan said that he doesn’t rule out more interest rate hikes ahead.

Read More »

Read More »

CHF traders take note – SNB Chair Jordan is speaking on Tuesday

High risk warning:

Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance. You could lose some or all your initial investment; do not invest money that you cannot afford to lose. Educate yourself on the risks...

Read More »

Read More »

2023-11-09 – Thomas Moser: Implementing monetary policy with positive interest rates and a large balance sheet: First experiences

In September 2022, the Swiss National Bank (SNB) raised its policy rate back into positive territory. At the same time, it adopted a new approach to implementing monetary policy in the money market. This approach employs two levers: the tiered remuneration of reserves, also referred to as reserve tiering, and reserve absorption.

Read More »

Read More »

2023-11-09 – Martin Schlegel: A pillar of financial stability – The SNB’s role as lender of last resort

As part of its contribution to the stability of the financial system, the Swiss National Bank acts as lender of last resort. In this role, it makes emergency liquidity assistance available to banks when, in crisis situations, they need substantial liquid funds which they are no longer able to obtain on the market.

Read More »

Read More »

Karsten Junius: «Schweizer Aktien bieten das attraktivste Kurspotenzial»

Auf welchem Pfad wird sich die Schweizerische Nationalbank (SNB) bewegen? Den Zinspeak haben wir auch in der Schweiz gesehen, selbst wenn Präsident Thomas Jordan jüngst noch einmal bekräftigt hat, dass die SNB die Zinsen falls nötig erneut erhöhen würde. Ich bin allerdings fest davon überzeugt, dass dies nicht der Fall sein wird.

Read More »

Read More »

Weniger SNB-Zinsen: UBS entgehen wohl 135 Millionen Dollar Einnahmen

Mit der verringerten Verzinsung von Sichtguthaben bei der Schweizerischen Nationalbank (SNB) dürften der UBS Einnahmen in Höhe von 135 Millionen Dollar entgehen.

Read More »

Read More »

USD/CHF Price Analysis: Golden cross loom, bulls hopeful target 0.9100

Share:

USD/CHF finds support at 0.9010, with buyers lifting pair to 0.9057 in late North American session.

'Golden cross' formation of 50-day moving average crossing above 200-day moving average opens door for bullish resumption.

Sellers must push prices below 0.9000 mark and reclaim latest cycle low at 0.8887 to maintain control.

The USD/CHF finds some support at around the...

Read More »

Read More »

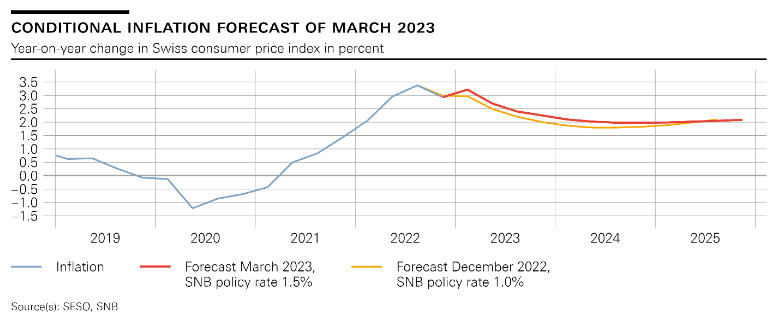

2023-03-23 – Monetary policy assessment of 23 March 2023

The SNB is tightening its monetary policy further and is raising the SNB policy rate by 0.5 percentage points to 1.5%. In doing so, it is countering the renewed increase in inflationary pressure. It cannot be ruled out that additional rises in the SNB policy rate will be necessary to ensure price stability over the medium term. To provide appropriate monetary conditions, the SNB also remains willing to be active in the foreign exchange market as...

Read More »

Read More »

Übernahme der Credit Suisse kostet jeden Schweizer 12’500 Franken

Für den Bundesrat ist der Übernahme-Deal zwischen UBS und Credit Suisse keine Staatsrettung. Dennoch tragen die Steuerzahler mit den Staatsgarantien enorme Risiken.

Read More »

Read More »

Swiss National Bank provides substantial liquidity assistance to support UBS takeover of Credit Suisse

UBS today announced the takeover of Credit Suisse. This takeover was made possible with the support of the Swiss federal government, the Swiss Financial Market Supervisory Authority FINMA and the Swiss National Bank.

Read More »

Read More »

«Status quo keine Option mehr»: Bekannter Bank-Experte sieht Übernahme der Credit Suisse durch UBS als Szenario Nummer Eins

Die Krise der Credit Suisse wird nach Einschätzung eines renommierten Branchenexperten von JPMorgan mit einer Übernahme der Bank enden.

Read More »

Read More »

While the focus was on Powell Tuesday there were also remarks from the ECB and SNB

Swiss National Bank Chair Jordan threatened FX intervention!

A couple of posts from Tuesday ICYMI while Powell was hogging the spotlight:

ECB Knot: ECB can be expected to keep raising rates for quite some time after March

ECB can be expected to keep raising rates for quite some time after March

And, SNB Chairman: We cannot rule out that we will have to tighten monetary policy again

We can use interest rates but also sell foreign...

Read More »

Read More »

Wie viele Arbeitsjahre bis zur Traumwohnung notwendig sind

Viele Menschen in der Schweiz können sich Wohneigentum nicht leisten. Und wer es kann, muss länger sparen als früher.

Read More »

Read More »

SNB dumps FANGS. Should You?

John Rubino and Patrick Highsmith of Firefox Gold return as guests on this week’s program.

The Swiss National Bank (SNB) loaded up on some of the largest cap stocks in the world like MSFT, GOOG, AMZN, TSLA, XOM and many more in order to weaken the Swiss francs vis-a-vis the Euro and the Dollar.

Read More »

Read More »

2023-02-16 – Markus K. Brunnermeier to hold the 2023 Karl Brunner Distinguished Lecture

The Swiss National Bank has named Markus K. Brunnermeier as the next speaker for its Karl Brunner Distinguished Lecture Series. Markus K. Brunnermeier is Professor of Economics at Princeton University and also Director of the Bendheim Center for Finance. His research focuses on the interaction between financial markets and the macroeconomy.

Read More »

Read More »

14R day shorting GBP and USD/CHF, oil was a setup

In this video I showcase the setups for selling into built-up longs in the NY session in cable and USD/CHF using SB strategy and an indicator template that I'm working on with rules...work in progress.

Read More »

Read More »

-638351136132631444-800x359.png)

-638453232816314704.png)