Category Archive: 1) SNB and CHF

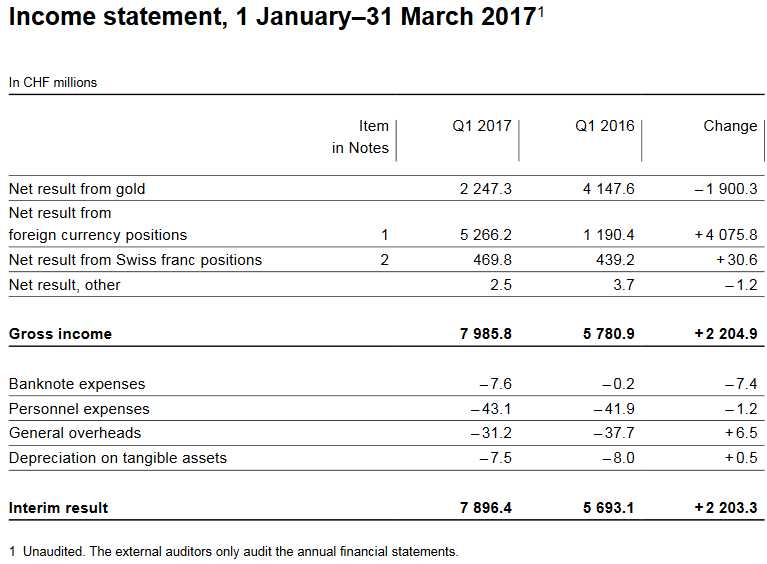

SNB posts 7.9 billion CHF Profit in Q1

The SNB reports a profit of 7.9 bn CHF, of which 2.2 bn come from the gold holdings. Given that the bank has introduced a "minimum euro rate" around 1.06-1.07, this is not very difficult. It comes at the price of continuing interventions.

Read More »

Read More »

Where There’s Smoke…

Central banks around the world have colluded, if not conspired, to elevate and prop up financial asset prices. Here we'll present the data and evidence that they've not only done so, but gone too far. When we discuss elevated financial asset prices we really are talking about everything; we're talking not just about the sky-high prices of stocks and bonds, but also of the trillions of dollars’ worth of derivatives that are linked to them, as well...

Read More »

Read More »

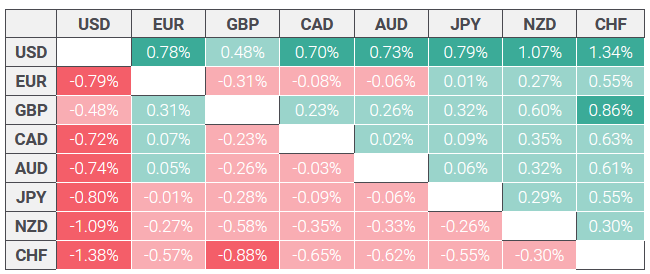

Euro gains against Swiss franc on French election result

The official French presidential election results place Emmanuel Macron (23.8%) and Marine Le Pen (21.5%) in first and second places in the first round of the French presidential race. The run off between these two will take place on 7 May 2017, when most forecasters expect Macron to win and become France’s next president.

Read More »

Read More »

Switzerland at IMF and World Bank 2017 Spring Meetings in Washington, D.C.

Federal Councillor Ueli Maurer as Head of the Swiss delegation, Federal Councillor Johann N. Schneider-Ammann and Thomas Jordan, Chairman of the Governing Board of the Swiss National Bank, will take part in the joint Spring Meetings of the International Monetary Fund (IMF) and the World Bank Group in Washington, D.C., from 21 to 23 April 2017. Prior to these meetings, Federal Councillor Ueli Maurer will represent Switzerland at the meeting of G20...

Read More »

Read More »

Swiss Franc Exchange Rate Index

The Swiss National Bank has updated its exchange rate indices. In an SNB Economic Studies paper, Robert Müller describes how. The upshot is that the SNB considers the Swiss Franc slightly less overvalued than before.

Read More »

Read More »

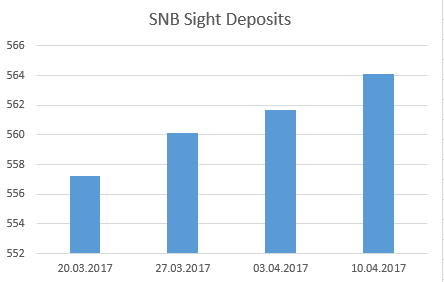

Weekly SNB Interventions and Speculative Positions: Back to 2.4 bn Intervention per Week

SNB sight deposits changed by 2.4 bn last week, hence the SNB intervened for this amount. This value is a movement back to the weekly intervention trend. We expect a further downtrend of EUR/CHF in the next 2 years.

Read More »

Read More »

End of EUR/CZK peg: Czech National Bank

The Czech National Bank (CNB) ended the EUR/CZK floor today. Timing was a little earlier than expected, but rising inflation and a robust economy warranted it. We think it’s too soon to talk about a rate hike, as we expect the koruna to overshoot to the strong side.

POLICY OUTLOOK

Price pressures are rising, with CPI accelerating to 2.5% y/y in February. March data will be reported April 10, with consensus at 2.6% y/y. If so,...

Read More »

Read More »

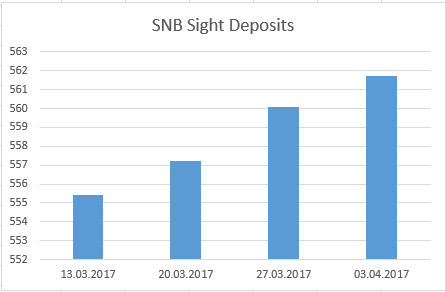

Weekly Sight Deposits and Speculative Positions: SNB interventions are rising again

The SNB intervenes for 1.6 bn CHF at EUR/CHF 1.07 - 1.0750. This is less than previously.

Read More »

Read More »

Unsere Exporteure sind die neuen Bauern. Statt deren Milch ist ihr Euro garantiert

Wie hoch würde der Euro gegenüber dem Schweizerfranken notieren ohne die Interventionen unserer Schweizerischen Nationalbank (SNB)? Das ist eine hypothetische Frage, die wissenschaftlich nicht exakt beantwortet werden kann. In der Nationalökonomie können wir ja keine Versuche im Labor durchführen.

Read More »

Read More »

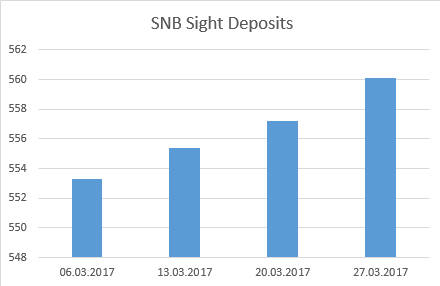

Weekly Sight Deposits and Speculative Positions: SNB interventions are rising again

The SNB intervenes for 2.9 bn CHF at EUR/CHF 1.07. For us, clearly too much and too risky; she will not maintain this pace over a longer term. Hence the EUR/CHF is prone to fall again.

Read More »

Read More »

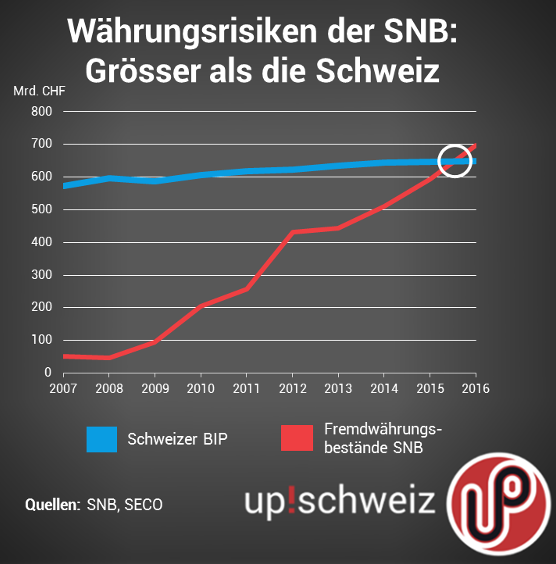

Riskante SNB-Politik: up! fordert Währungswettbewerb

Die Schweizerische Nationalbank (SNB) hat am Donnerstag ihren Geschäftsbericht publiziert und musste erneut heftige Kritik vor der Schweizer Unabhängigkeitspartei up! einstecken. up! kritisiert insbesondere die expansive Geldpolitik, die zu Fremdwährungsreserven von 692 Milliarden Franken geführt hat. Zudem fordert up! einen Übergang von der staatlichen Währung zu einem System von Marktwährungen.

Read More »

Read More »

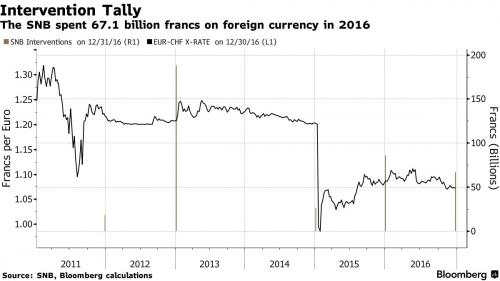

SNB Spent $68 Billion On Currency Manipulation In 2016

While Donald Trump has repeatedly expressed his displeasure with China for manipulating its currency, he appears to have recently figured out that over the past 2 years Beijing has been spending hundreds of billions in dollar to strengthen, not weaken, the Yuan and to halt the ~$1 trillion in capital flight from China.

Read More »

Read More »

2016 Annual Report of the Swiss National Bank

The Swiss National Bank carried out foreign exchange interventions totaling 67.1B Swiss francs in 2016 in order to counter "an undesired tightening of monetary conditions," the central bank disclosed in its annual report. That was down from 86.1B francs in 2015, when the SNB intervened heavily at the start of the year following its decision to remove a cap on the franc's value against the euro.

Read More »

Read More »

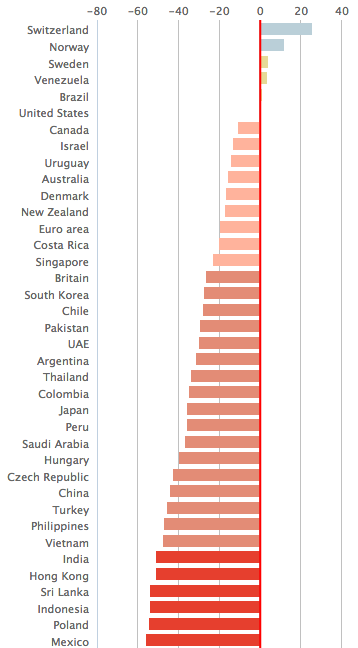

The Swiss Franc: The World’s Most Perplexing Currency?

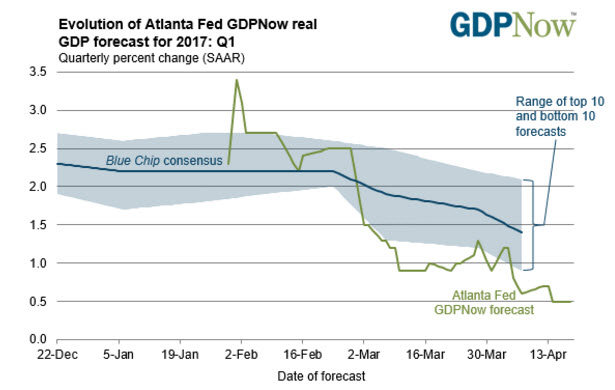

Swiss policymakers consider their domestic currency (the franc, or CHF) to be significantly overvalued. Measures taken by the Swiss National Bank seem to corroborate this stance, holding its nominal overnight rates well into negative territory. Considering where the Fed and ECB are in their policy cycles and where the SNB is in its cycle, the USD and EUR are likely to appreciate against the CHF.

Read More »

Read More »

New calculation of SNB exchange rate indices

Change to a more comprehensive and up-to-date methodology. The Swiss National Bank (SNB) is putting the Swiss franc exchange rate indices it calculates and publishes on a new footing. The adjustment allows the Swiss economy’s competitive and trading relationships to be replicated in a more comprehensive and up-to-date way. The new indices, too, show that the Swiss franc is significantly overvalued.

Read More »

Read More »

-638453232816314704.png)