1. The election in Spain did not lift the uncertainty but re-redoubled it. Given the outcome, it is difficult envision a majority government. Purely looking at the numbers, a coalition between the Popular Party and the Socialists is simplest solution. It is like Pasok and the New Democracy in Greece and the Christian and Social Democrats in Germany. While such grand coalitions maybe political expedient, it sends a powerful signal that there is not a significant difference between the two "brands". Ultimately this is fodder for populists and demagogues.

Spanish assets had been underperforming in Europe in recent weeks, and this intensified in the immediate response to the election result. The key comparison is Italy. Spain's 10-year yield rose seven bp (to 1.76%) while Italy's rose 1.5 bp (to 1.59%). Italy's two-year yield was off 1.5 bp to dip below four bp. Spain's two-year yield was unchanged at eight bp.

Spain's shares fell 3.6% on Monday, bringing the year-to-date loss to 8.8%. Despite one of the strongest economies in the EU in 2015, Spain's equity performance is among the worst. Italian shares were 0.65% on Monday and are up 10.6% for the year.

It will take several weeks to sort things out in Spain. Until it is, Spanish asset can be expected to underperform. This may create new opportunities for value investors.

2. Kuroda's explanation of BOJ's new initiatives contained a warning. We suggested that the BOJ's moves were largely operations tweaks to minimize the disruption of the BOJ's continued large-scale asset purchases. Going over Kuroda's comments, something more was evident (from Bloomberg): "This will make it possible to proceed with asset purchases even more smoothly and it will make us firmly continue qualitative and quantitative easing. Also, I want you to understand that today's adjustment were to enable us to quickly respondwhen we judge we need more action for attaining the price target at the earliest time possible."

The second sentence seems to suggest a greater likelihood of additional action. The decline in energy and commodity prices more broadly add to the deflationary pressures. Over the past year, for all practical purposes, the yen is flat (off 1% against the dollar) and this may on import prices soon. The supplemental budget may prove an insufficient of a fillip for prices. The start of the new fiscal year in April may be too soon, but additional BOJ action later in 2016 cannot be ruled out.

3. When is the Fed's next hike? The Financial Times survey of 42 economists found 2/3 expect the next move in March. More than half expect the third hike in June. Most only expected 2-3 hikes in 2016. There remains a wide gap between the survey and investors as reflected in short-term derivative contracts.

The March Fed funds contract is implying an average effective rate of 42 bp in March. Fed funds have been averaging 37 bp (and if you are counting at home, remember Friday's rate applies to Saturday and Sunday too) though today may be a little lower. So far the operationally, the process looks to be fairly smooth. It has not required large reverse repo operations to lift the Fed funds rate.

4. The EU agreed to extend sanctions against Russia until the end of July. Barring a serious deterioration of the situation in Ukraine, there is risk that there will not be a consensus to extend them further. France, Italy, and a few other countries want to re-engage with Russia. Russia has withstood bulk of the pain. In Q3 15 the economy was a little more than 4% smaller than a year ago. The depreciation of the ruble has facilitated what appears to be the highest oil output since the Soviet era, with Russia gaining market share in China, according to press reports. Meanwhile, US oil producers added seven rigs last week. Output increased for the fifth time in eight weeks.

5. The Doha Round of trade talks appears to have been defenestrated over the weekend. The 162 member of the WTO failed, for the first time, to "reaffirm" it. This effectively ends the negotiations. The US and Europe had been pushing for this result, apparently wanting to cut their losses. The lack of progress was making the WTO less relevant. This will allow a new agenda to arise. Instead of some grand omnibus move, look for smaller, issue-specific approach. The growing digital economy and investment are possible issues. An agreement was struck to liberalize agricultural trade further and give cotton producers greater access to developed countries' markets.

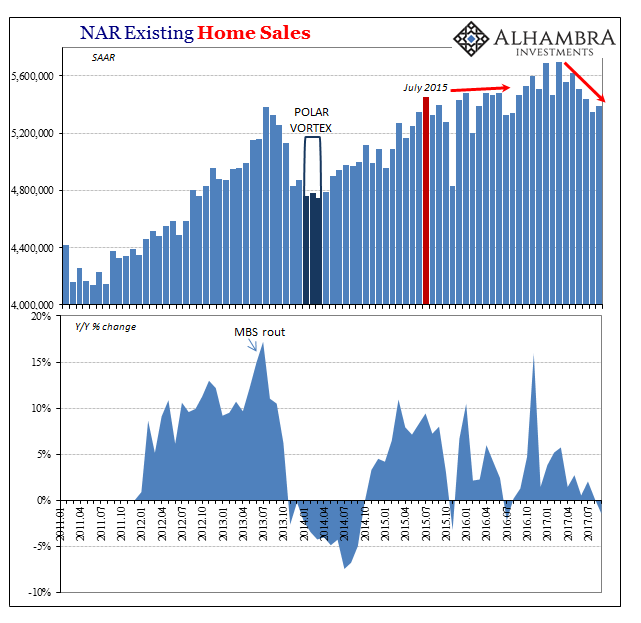

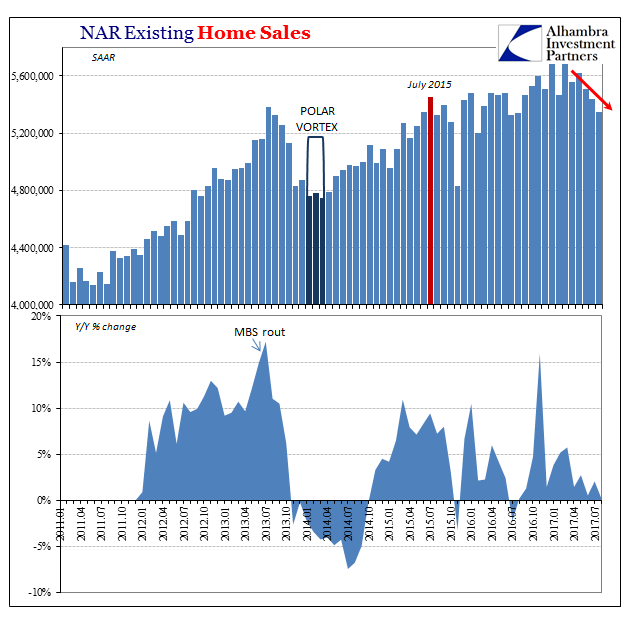

6. US offers a revision to Q3 GDP and reports November existing home sales. Due to inventories and less spending on medical services, Q3 GDP will likely be revised down from 2.1% to 1.9%. The Atlanta Fed says that Q4 GDP is also tracking 1.9%. Growth in the first two-quarters averaged 2.25% (though not evenly distributed). Existing home sales rose through July but have been losing some traction ever since. Another soft report is expected.

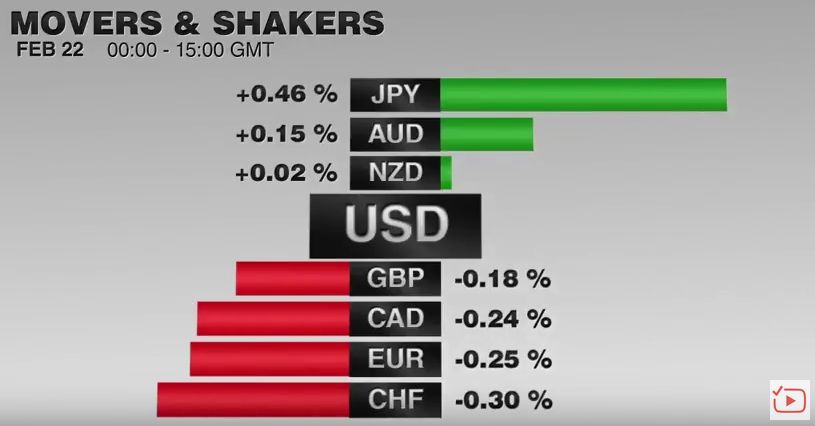

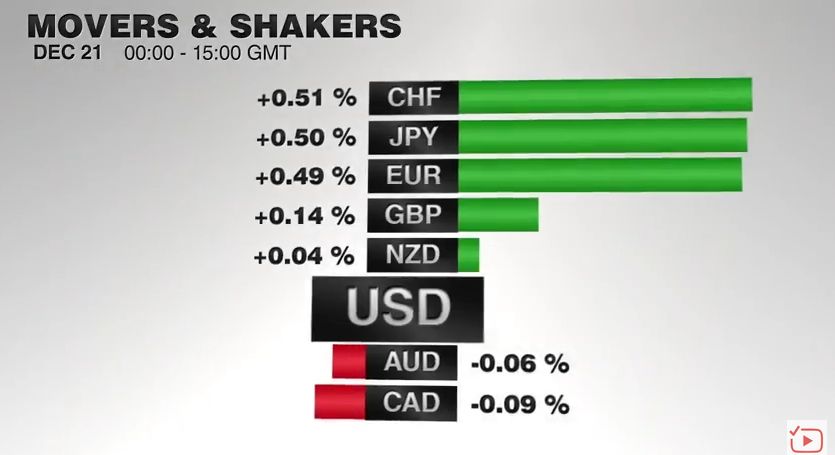

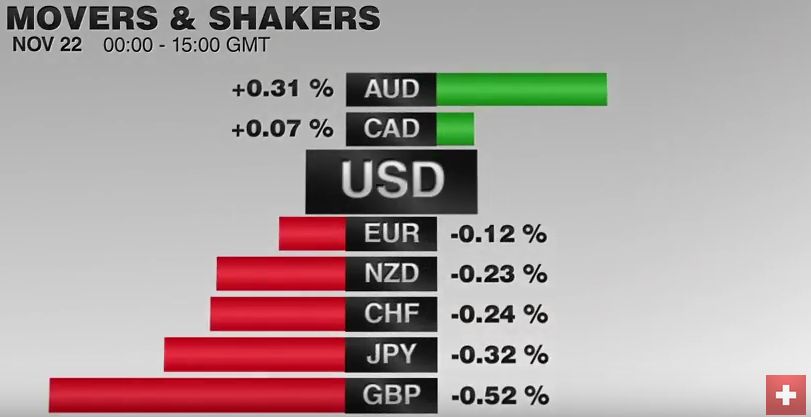

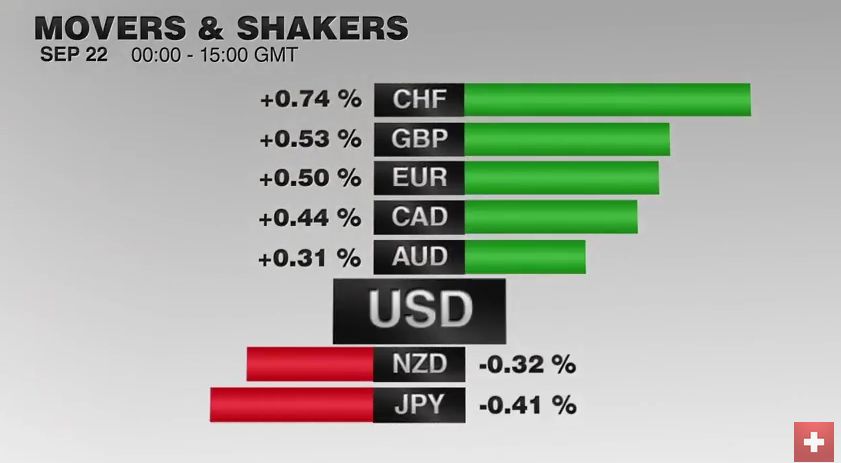

7. The US dollar continues to trade offered. Holiday-markets and position adjustments continues. Against the euro and many other currencies, the dollar rallied from mid-October through early-December. A downside correction for the dollar began with the ECB meeting. The price action suggests to us that the correction is not over. Be patient. The Australian dollar is interesting. A move above $0.7210 now could spur a move toward $0.7280, plus the forward points work in your favor if one was looking for a place to park funds over the holidays. The Kiwi looks constructive, but it appears to be further away from support, which means it may be more expensive than the Aussie if they sell-off. The oil soft and the US premium over Canada (two-year) edging higher, the Canadian dollar appears poised to underperform. Sterling also acts like a dog. It cannot get out of its own way. $1.4750-$1.4800 is the next technical target.

Tags: U.S. Existing Home Sales