Strange diversion of conditional inflation forecasts: At the ECB Meeting Draghi expected inflation to rebound to 1.2% next year and 1.6% in 2018.

The SNB, however, predicts 2017 inflation at 0.2% and 2018 at 0.6%.YoY CPI Inflation in Germany is at 0.4%, in France 0.3%, in Italy and Spain near or under zero. Switzerland sits on a real estate bubble that sooner or later will translate into rents and prices. Rents in Spain have fallen by 4.4% against last year, after their real estate bust some years ago.

Wages in Switzerland are up 0.8% but they have risen less in Italy or Spain.One of these two forecasts must be wrong! My guess is that Draghi will be wrong.

Swiss National Bank leaves expansionary monetary policy unchangedThe Swiss National Bank (SNB) is maintaining its expansionary monetary policy. Interest on sight deposits at the SNB is to remain at–0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%. At the same time, the SNB will remain active in the foreign exchange market, as necessary. The negative interest rate and the SNB’s willingness to intervene in the foreign exchange market are intended to make Swiss franc investments less attractive, thereby easing upward pressure on the currency. The Swiss francis still significantly overvalued. The SNB’s expansionary monetary policy is aimed at stabilising price developments and supporting economic activity.

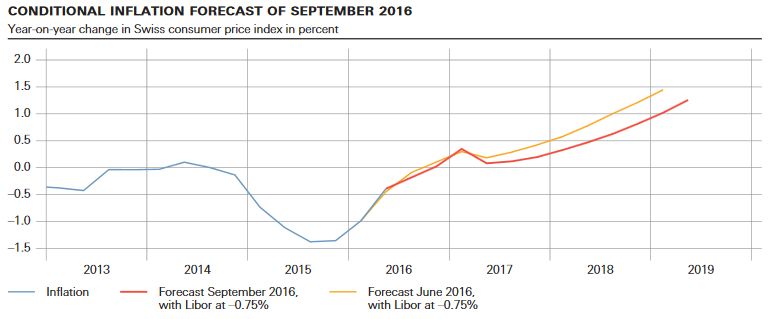

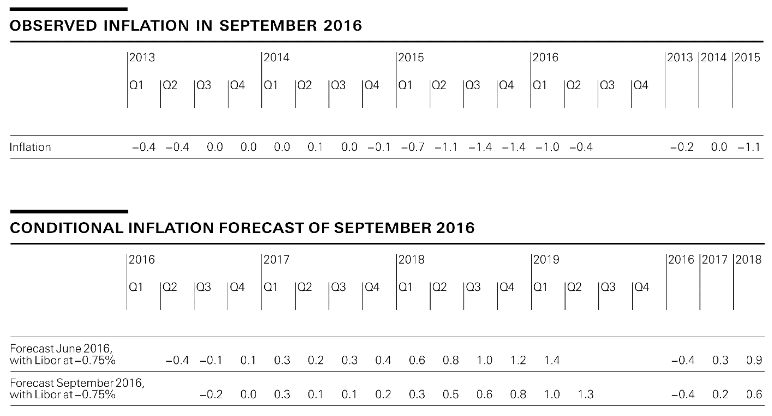

The new conditional inflation forecast has been revised slightly downwards compared to the June forecast. Up to the first quarter of 2017, the path of inflation remains almost the same.Thereafter, the slightly less favourable global economic outlook dampens inflation in Switzerland. For 2016, the inflation forecast remains unchanged at –0.4%. For 2017, the SNB expects inflation of 0.2%, compared to 0.3% forecast in the last quarter, while for 2018, the forecast has fallen from 0.9% to 0.6%. The conditional inflation forecast is based on the assumption that the three-month Libor remains at –0.75% over the entire forecast horizon.

The gradual recovery of the global economy continued in the second quarter. In the US,economic activity was driven mainly by strong consumer demand, and labour market developments continued to be favourable. In European countries, economic performance varied. In France and Italy, it stagnated, wher eas Germany, Spain and the UK once again saw healthy growth. The Chinese economy, too, expa nded robustly on the back of monetary and fiscal stimulus measures. Overall, international growth was principally driven by domestic demand and the services sector. By contrast, global manufacturing and trade remained subdued.

|

SNB Switzerland Conditional Inflation Forecast(see more posts on Switzerland inflation, ) |

|

The SNB still expects the moderate growth in the global economy to sustain over the coming quarters. However, the vote for the UK to leave the European Union has caused considerable uncertainty and makes an assessment of the global economic outlook more difficult. The SNB has revised downwards its growth expectations for the UK and the euro area. As regards the global economy, the risks remain to the downside, owing to numerous structural problems.

In the second quarter, the Swiss economy posted growth of 2.5% on an annualised basis. Overall, the revised quarterly estimates for GDP suggest a somewhat stronger recovery of the Swiss economy since the middle of last year. Nonetheless, on the whole, capacity utilisation remains unsatisfactory. Moreover, not all industries have benefited equally from the recovery. As a result, margins at a large number of companies continue to be strained.

The SNB is anticipating a continuation of the recovery. In the second half of the year, however, growth is likely to be more modest than in the first half, partly owing to a temporary weakening of growth in Europe. For 2016 as a whole, the SNB now expects growth of approximately 1.5%. The recovery is likely to spread gradually to the labour market. The seasonally adjusted unemployment rate should stabilise over the coming months.

While growth in real estate prices weakened overall in the second quarter, growth in mortgage lending was virtually unchanged compared to the previous quarter. According to the SNB’s assessment, imbalances on the mortgage and real estate markets persist. The SNB will continue to monitor developments on these markets closely, and will regularly reassess the need for an adjustment of the countercyclical capital buffer.

|

Switzerland Inflation and Inflation Forecast(see more posts on Switzerland inflation, ) |

Full story here Are you the author? Previous post See more for Next post

Tags: inflation expectations,newslettersent,Switzerland inflation