On the FT’s Alphaville blog, Matthew Klein reviews Swiss monetary policy over the last years and its effect on the real economy. He concludes that

|

SNB Holdings, 2001 - 2017(see more posts on SNB Holdings, ) |

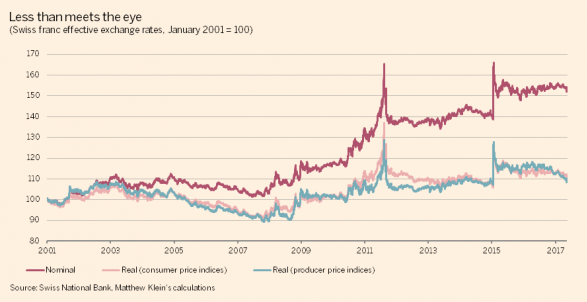

Swiss Franc Exchange Rates, 2001 - 2017 |

Full story here Are you the author? Previous post See more for Next post

Tags: balance sheet,exchange rate,newslettersent,Notes,SNB Holdings,Swiss Franc,Swiss National Bank

1 comment

Stefan Wiesendanger

2017-06-06 at 14:05 (UTC 2) Link to this comment

Stefan Wiesendanger @wiesenda

Mr. Klein makes a reasonable argument that in hindsight, the SNB might have done too much. His allegation of predatory mercantilism is however far removed from the truth: the SNB is just trying to fulfil its mandate of stability. The following two points illustrate this:

1. Traditionally, the main channel for reinvesting the consistent current-account surplus abroad were the two big banks, UBS and CS. In the wake of the US and EUR crises, they were forced to de-leverage by 50%, not least by regulatory pressure emanating from the SNB. It is only fair that the capital pouring back into the country from this gigantic retrenchment should be absorbed by the SNB rather than destabilising the CHF.

2. The Swiss economy overall continues to perform well in spite of the CHF appreciation. This is however not true for all industry. The machinery sector risks to bleed out in direct competition with its peers in Southern Germany who benefit from a EUR that is far too low for them. Should Switzerland sacrifice an entire branch of core competence that took decades to centuries to build just because of a temporary currency aberration in relation to neighbouring Southern Germany, just a dozen kilometers away in many cases? I agree that this can be seen as mercantilism by those who see the current situation as permanent, but then should not Germany bear at least part of the blame?

Regarding the future, it seems clear to me that Switzerland needs to create a new channel to profitably export its traditional savings surplus. Clearly, the banking channel has been a disaster. Switzerland would be a natural breeding ground for an outward private equity industry. Such private capital outflows are what is needed to reduce the SNB balance sheet (i.e. turning private CHF claims against the SNB into private claims against foreign assets) without disturbing the currency relations.