Tag Archive: capital flows

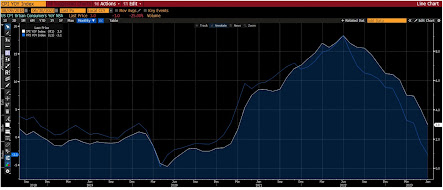

Quiet End to a Busy Week

Overview: The US dollar is winding down this week on

a quiet note. Most of the G10 currencies are trading within yesterday's ranges.

On the week, only the Scandis are set to close with gains, though with a little

effort, the Australian dollar could too. The Japanese yen and Swiss franc are

the laggards off 0.65%-0.75% this week. Most emerging market currencies outside of

central Europe are firmer. The South African rand is the strongest this...

Read More »

Read More »

Food Prices Drive China’s CPI Lower while the Greenback is Mostly Firmer in Narrow Ranges

Overview: The dollar is mostly firmer against the

G10 currencies and has been confined to tight ranges through the European

morning. Outside of the China's deflation and Japan's monthly portfolio flow

data that showed Japanese investors bought the most amount of US Treasuries

(~$22 bln) in six months in September, the news stream is light. Most emerging

market currencies are trading with a softer bias today. The Philippine peso is

the strongest...

Read More »

Read More »

BRICS to Expand a Little, USD Steadies after Yesterday’s Retreat, Attention Turns to Jackson Hole

Overview: Strong Nvidia's earnings after the US

markets closed yesterday helped lift Asia Pacific markets today. All the large

bourses were higher but India. Hong Kong, South Korea, and Taiwan indices rose

more than 1%. Europe's Stoxx 600 is higher for the fourth consecutive session

and US index futures are higher, led by the NASDAQ. European benchmark bond

yields have extended yesterday's PMI-induced decline and are mostly 1-2 bp

lower. The...

Read More »

Read More »

Aussie Recovers from Poor Jobs Data, but Nokkie is Weaker Despite Rate Hike

Overview: Encouraged by the continued stream of US data, which

suggests that the world's largest economy is accelerating, the US 10-year yield

is approaching last year's 4.33% high, and the dollar's run has lifted it to

new highs for the year against the Japanese yen, Chinese yuan, and the

Australian and New Zealand dollars. Even a rate hike by Norway did not stop the

dollar from rising against the krone. The greenback is firmer against most of

the...

Read More »

Read More »

The Greenback is Softer Ahead of CPI but Key Chart Points Remain Intact

Overview: The deluge of Treasury supply is nearly

over for this week. On tap today are 4- and 8-week T-bills and $23 bln 30-year

bonds to finish the quarterly refunding. The sales will come after the July CPI

print that is expected to see the first year-over-year increase since last June.

The market is going into the report with about a 15% chance of a Fed hike next

month discounted. Meanwhile, September crude oil extended its recover from $80

seen...

Read More »

Read More »

RBNZ Delivers a Dovish Hike and UK Inflation Surprises to the Upside

Overview: Equities in the Asia Pacific region and

Europe are being led lower by the sell-off in the US yesterday. All the large

Asia Pacific markets fell with Hong Kong and mainland shares setting the pace.

Europe's Stoxx 600 is off nearly 1.5%, which would be the largest loss in two

months. Consumer discretionary, financials and real estate sectors are off

nearly 2%. US equity futures have a softer bias. European 10-year yields are

mostly 2-3 bp...

Read More »

Read More »

Equities Retreat while the Dollar is Confined to Narrow Ranges

Overview: Equities are mostly lower, while bonds have risen. The

dollar is trading in narrow ranges and mixed against the G10 currencies and

emerging markets. Most Asian bourses were lower. The Nikkei (though not the

Topix) and Hong Kong were the chief exceptions. Europe's Stoxx 600 is off for

the second consecutive day, in what looks like the first back-to-back loss

since early this month. US equity futures are lower, with the NASDAQ, which

eked...

Read More »

Read More »

Dollar Soft but Stretched

Overview: While bank stress seems to continue

to ease, the dollar languishes against most of the major currencies. The

Japanese yen is the notable exception. It is off about 1.5% this week. The

Dollar Index has given back the gains scored at the end of last week but

remains inside the range set last Thursday and Friday (~101.90-102.35). Perhaps

the participants are waiting for Friday. In addition to month-, quarter, and

fiscal-year ends, it is...

Read More »

Read More »

Firmer Rates and Higher Bank Stocks Give the Greenback Little Help

Overview: Financial strains eased yesterday, and

short-term yields jumped. The two-year US yield jumped 25 bp to pierce 4%. Yet,

the dollar fell against most of the major currencies yesterday and is mostly

softer today. Banking stress is ebbing. The Topix bank index snapped a

three-day decline and jumped nearly 2% today to recoup the lion's share of its

three-day decline. The Stoxx 600 index of EMU banks is extending yesterday's

1,7% advance. The...

Read More »

Read More »

Higher for Longer Helps the Dollar while Weighs on Equities

Overview: The jump in prices paid in yesterday's US

ISM manufacturing coupled with the stronger eurozone inflation, with a new

cyclical high reported in the core rate, underscores the market theme of

higher-for-longer. This is seen as dollar supportive but also negative for

risk-assets, including and especially equities. European benchmark 10-year

yields are up another couple of basis points today and the 10-year US Treasury

yield is pushing above...

Read More »

Read More »

Ueda Day

Overview: Rising rates and falling stocks provided the

backdrop for the foreign exchange market this week. The dollar appreciated

against all the G10 currencies but the Swedish krona, which is still correcting

higher after the hawkish pivot by the central bank. The market looks for a

later and higher peak in the Fed funds rate. This coupled with the risk-off

sentiment helped the dollar extend its recovery after falling since last...

Read More »

Read More »

US Interest Rate Adjustment Post-Jobs is Over as the 2-Year Yield Backs Away from 4.50%

Overview: The capital markets have shrugged off the

more than 1% loss of the Nasdaq and S&P 500 yesterday and have jumped back

into risk assets. The stocks and bonds have been bought and the dollar sold. Chinese

and Hong Kong shares gained more than 1% today. Japan was mixed and Taiwan and

South Korean equites saw minor losses. Europe's Stoxx 600 is up over 1%. Nasdaq

futures are up nearly 1.2% while the S&P 500 is lagging slightly....

Read More »

Read More »

Sharp Dollar Setback may offer Bulls a Bargain

The dollar is having one of the largest setbacks in recent weeks. We expected the dollar to soften ahead of next week’s CPI, which may fan ideas/hopes of a peak in US price pressures, but the magnitude and speed of the move is

surprising, and likely speaks to the extreme positioning.

Read More »

Read More »

FX Daily, March 16: Equities Firm, but Markets Tread Gingerly

Overview: Yesterday's new record highs in the S&P 500 and Dow Jones Industrial helped set the tone for today's advance in the Asia Pacific region and Europe. The MSCI Asia Pacific Index snapped a two-day decline, with other major markets rising today.

Read More »

Read More »

FX Daily, April 2: Optimism on Oil Deal Steadies Risk Appetites…for the Moment

Overview: After US stocks dropped more than 4% yesterday, investor sentiment has improved, apparently sparked by ideas that the pain will force oil producers to find a way to reduce supply. Oil prices have surged, with the May WTI contract rallying around 7%. Asia Pacific equities were mostly higher, with Japan and Australia the notable exceptions.

Read More »

Read More »

Forex Forensics: The Case of the Yen

Over the past five sessions, the yen is the strongest of the major currencies, appreciating about 1.7% against the US dollar, eclipsing the Swedish krona, which rallied strongly today after the Riksbank's surprise rate hike. Given the sell-off in equities and the decline in markets, the yen's strength is not surprising.

Read More »

Read More »

Capital Flocks to the US

The US policy mix gets a privileged place in our understanding of what is the dollar. Tighter monetary policy and looser fiscal policy could be the closest thing to an elixir for currencies. It is the policy mix that the US is pursuing.

Read More »

Read More »

Tensions Beyond Trade

Chinese officials do not seem to appreciate the extent of its isolation. The disruption from the US as Trump positions the US as a revisionist power-one that wants to alter the world order, which it was instrumental in constructing, may have obscured the fact that China's practices are a source of frustration and animosity broadly and widely.

Read More »

Read More »

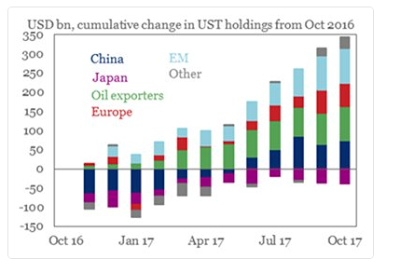

Great Graphic: Treasury Holdings

The combination of a falling dollar and rising US interest rates has sparked a concern never far from the surface about the foreign demand for US Treasuries. Moreover, as the Fed's balance sheet shrinks, investors will have to step up their purchases.

Read More »

Read More »

Impressive Japanese Flows at the end of the Fiscal Year

Japanese investors bought foreign bonds in the last week of March for the first time in nine weeks. Foreigners bought the most Japanese stocks since last April. The pain trade is for a break of JPY110.

Read More »

Read More »