Tag Archive: federal-reserve

Fragile Calm Returns and Powell’s Anti-Inflation Rhetoric Ratchets Up

Overview: Into the uncertainty over the implications of Omicron, the Federal Reserve Chairman injected a particularly hawkish signal into the mix in his testimony before the Senate. These are the two forces that are shaping market developments. Travel restrictions are being tightened, though the new variant is being found in more countries, and it appears to be like closing the proverbial barn door after the horses have bolted. Equities are...

Read More »

Read More »

Sentiment Remains Fragile

Overview: The fire that burnt through the capital markets before the weekend, triggered by the new Covid mutation, burned itself out in the Asian Pacific equity trading earlier today. A semblance of stability, albeit fragile and tentative, has emerged. Europe's Stoxx 600 is up about 1%, led by real estate, information technology, and energy. US index futures are trading higher, with the NASDAQ leading. Benchmark 10-year yields are firmer. The US...

Read More »

Read More »

Jobs (US) and Inflation (EMU) Highlight the Week Ahead

The new covid variant and quick imposition of travel restrictions on several countries in southern Africa have injected a new dynamic into the mix.

Read More »

Read More »

Tech Sell-Off Continues

Overview: The markets are unsettled. Bond yields have jumped, tech stocks are leading an equity slump, and yesterday's crude oil bounce reversed. Gold, which peaked last week near $1877, has been dumped to around $1793. The tech sell-off in the US carried into the Asia Pacific session, and Hong Kong led most markets lower. The local holiday let Japanese markets off unscathed, though the Nikkei futures are off about 0.4%. Australia and India...

Read More »

Read More »

Biden-Xi “Summit” Leaves Markets Unmolested, While Bailey Continues to Blame Investors for Misunderstanding Him

[unable to retrieve full-text content]Overview: The much-heralded Biden-Xi meeting left little impression on the capital markets. Equities in the region were mixed, and China's main markets fell, alongside Australia, South Korea, and India. European equities continue their upward market, with the Stoxx 600 gaining for a fifth consecutive session. US futures are softer. The bond market is quiet, with the US 10-year yield softer slightly below...

Read More »

Read More »

What Might it Take for the Fed to Deliver a Hawkish Tapering Announcement?

Overview: With the FOMC's decision several hours away, the dollar is trading lower against nearly all the major currencies. The Antipodeans and Norwegian krone are leading. The euro, yen, and sterling are posting minor gains (less than 0.1%). Most of the freely liquid and accessible emerging market currencies are also firmer. The Turkish lira is a notable exception. The decline in the core inflation and a smaller than expected rise in the...

Read More »

Read More »

Bill Issuance Has Absolutely Surged, So Why *Haven’t* Yields, Reflation, And Other Good Things?

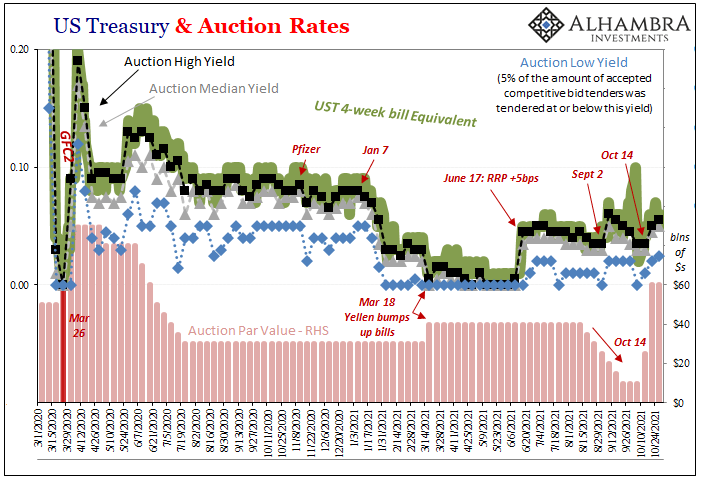

Treasury Secretary Janet Yellen hasn’t just been busy hawking cash management bills, her department has also been filling back up with the usual stuff, too. Regular T-bills. Going back to October 14, at the same time the CMB’s have been revived, so, too, have the 4-week and 13-week (3-month). Not the 8-week, though.

Read More »

Read More »

The Week Ahead: Four Central Banks and the US Jobs Report

The Bank of England and the Federal Reserve meetings are the highlights of the week ahead. Usually, the US jobs report is the main feature of the beginning of a new month's high-frequency data cycle. However, the FOMC meeting two days earlier may take away some of its significance, even if it still possesses some headline risk. Two other major central banks meet in the first week of November. The Reserve Bank of Australia meets early on November...

Read More »

Read More »

A Short Note on the Pricing of the Fed Funds Futures: Aggressive

In assessing the trajectory of Fed policy the market is discounting, we prefer using the Fed funds futures contracts over the Eurodollar futures. The Fed funds settle at the average effective rate, while the Eurodollar futures contracts are three-month deposit rates.

Read More »

Read More »

Soaring Energy Prices Lift Yields, Weigh on Equities and the Greenback Pops

Overview: Rising energy prices and yields are helping lift the US dollar and weighing on equities. November WTI has pushed above $76, while Brent traded above $80, and natural gas is up for the fourth consecutive session, during which time it has risen by about 25%.

Read More »

Read More »

Taper, No Tantrum

Overview: The market's reaction to the FOMC statement was going according to our script, with the dollar backing off on a buy rumor sell the fact type of activity until Powell provided an end date for the tapering (mid-2022) before providing a start date (maybe next month). This spurred a dollar rally.

Read More »

Read More »

Risk Appetites Return from Holiday

Overview: After an ugly week, market participants have returned with strong risk appetites. Equities are rebounding, and the greenback is paring recent gains. Bond yields are firm, as are commodities. Asia Pacific equities got the ball rolling with more than 1% gains in several large markets, including Japan, China, Hong Kong, and Taiwan.

Read More »

Read More »

Quantitative Easing: A Boon or Curse?

Central banks’ massive Quantitative Easing (QE) programs have come under scrutiny many times since the central banks fired up the printing press and began quantitative easing programs en masse after the 2008-09 Great Financial Crisis.

However, the increase in central bank assets due to quantitative easing programs during the crisis pale in comparison to the QE programs during the Covid pandemic.

As economies recovered after the...

Read More »

Read More »

FX Daily, July 15: Strong Gains in US CPI and PPI Don’t Stop the Bond Market Rally

Strong inflation prints this week have not prevented the long-term US interest rates from tumbling. The 10-year yield is about 10 bp lower than where it closed on Tuesday after the lackluster 30-year auction. The 30-year yield itself is 11 bp lower.

Read More »

Read More »

FX Daily, July 14: RBNZ Moves Ahead of the Queue, Will the Bank of Canada Maintain its Place?

The Reserve Bank of New Zealand jumped to the front of the queue of central banks adjusting monetary policy by announcing the end of its long-term asset purchases. New Zealand's s 10-year benchmark yield jumped seven basis points, and the Kiwi is up almost 1%, to lead the move against the greenback today.

Read More »

Read More »

Measuring Inflation and the Week Ahead

There is quite an unusual price context for new week's economic events, which include June US CPI, retail sales, and industrial production, along with China's Q2 GDP, and the meetings for the Reserve Bank of New Zealand, the Bank of Canada, and the Bank of Japan.

Read More »

Read More »

FX Daily, July 08: Capital Markets Remain Unhinged

The dramatic move in the capital markets continues. The US dollar is soaring as yields and equities slide. The US 10-year yield has fallen below 1.30 to 1.26% European benchmark yields are 1-4 bp lower, while Australia and New Zealand have seen a 7-9 bp drop today.

Read More »

Read More »

FX Daily, June 24: Did the PBOC Signal it is Content with the Yuan’s Pullback?

The US dollar is trading slightly lower against most of the major and emerging market currencies. The Scandis are leading the major currencies, while the Russian ruble leads the central and eastern European currencies higher. Emerging market currencies mostly firmer, though the Turkish lira and South African rand are notable exceptions.

Read More »

Read More »

FX Daily, June 23: Japan Retains Distinction of being the only G7 Country with Sub-50 PMI Composite

Federal Reserve officials, lead by Chair Powell, pushed gently against the more hawkish interpretations of last week's FOMC meeting. Tapering not a rate hike was the focus of discussions. Powell reiterated that price pressures would prove transitory and would ease after the re-opening disruptions settled down.

Read More »

Read More »

The Inflation Tide is Turning!

2021-10-09

by Stephen Flood

2021-10-09

Read More »