Tag Archive: federal-reserve

Markets Catch Collective Breath

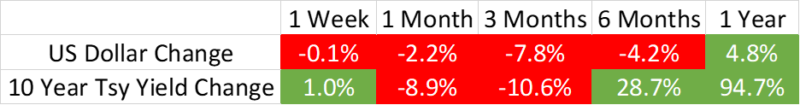

Overview: After last week's flurry of activity that saw the US

dollar extend its recovery, it has begun off the new week largely consolidating

in relatively narrow ranges. The Australian and New Zealand dollar's remains

softer, and the Swiss franc is virtually flat, but the other G10 currencies,

led by sterling are posting small gains. A break-through on the Northern

Ireland protocol, which has been rumored for a more than a week may be

announced...

Read More »

Read More »

Ueda Day

Overview: Rising rates and falling stocks provided the

backdrop for the foreign exchange market this week. The dollar appreciated

against all the G10 currencies but the Swedish krona, which is still correcting

higher after the hawkish pivot by the central bank. The market looks for a

later and higher peak in the Fed funds rate. This coupled with the risk-off

sentiment helped the dollar extend its recovery after falling since last...

Read More »

Read More »

Fed Tightening Seen Extending into Q3

Overview: The prospect that the Federal Reserve tightening

cycle continues into early Q3 is underpinning the greenback today against

most of the G10 currencies. The dollar bloc is the notable exception, and they

are posting minor gains, perhaps encouraged by the firmer equity markets. The

minutes of this month’s FOMC meeting appear to show wide support for quarter

point hikes going forward and there did not seem to be much discussion of the...

Read More »

Read More »

Markets Catch Collective Breath

Overview: On the

heels of a dramatic jump in US job creation and firmer than expected

year-over-year CPI, the US reported a larger than expected jump in retail sales

and a strong recovery in manufacturing output. Few think that economic momentum

that the recent data implies can be repeated, the "no landing" camp

has gained adherents. We suspect that says more about psychology than the

economy. The US two-year note is threatening to snap...

Read More »

Read More »

Yen Retreats Ahead of Formal BOJ Announcement Tomorrow and US CPI

Overview: A consolidative tone is mostly the theme of the day. The revisions to the US CPI announced before the weekend add to the uncertainty and focus on tomorrow's report. At the same time, investors watch ongoing air space activity that has led to a few objects being shot down over the US and Canadian airspace.

Read More »

Read More »

Markets Calm after Dramatic Swings on Powell’s Comments

The US dollar is mostly trading with a downside bias today against the G10 and most emerging market currencies. It had begun the week extending the gains spurred by the dramatic jump in nonfarm payrolls and the strong ISM services survey. Market expectations for the trajectory of Fed policy in the first part of this year converged with the Fed's December dot plot. The market now leans toward two more quarter-point hikes this year.

Read More »

Read More »

Greenback Extends Recovery

Overview: The honeymoon for risk assets that began

the year ended with a bang at the end of last week with the monster US jobs

report and the rebound in the service ISM. Disappointing news from several large

US tech companies provided extra encouragement. The yen's weakness helped

Japanese stocks today, but the other larger bourses in the Asia Pacific area

were sold, with losses in Hong Kong, the CSI 300, South Korea, and Taiwan off

more than 1%....

Read More »

Read More »

Will What the Fed Says be More Important than What it Does?

Overview: The focus is squarely on the Federal Reserve today. There is nearly universal agreement that it will lift the target by 25 bp. The market is inclined to see the shift as a sign that the Fed is nearing the end of its tightening cycle, and sees, at most, one more quarter-point hike. Despite the Fed's warnings, including in the December FOMC minutes, about the premature easing of financial conditions, the market has done precisely that.

Read More »

Read More »

Weekly Market Pulse: First, Kill All The Speculators

The Fed meets this week and is widely expected to raise the Fed Funds rate by 0.25% to a range of 4.5% – 4.75%. The market has factored in a small probability that they do nothing and leave rates alone, but they’ll probably do what’s expected because they’ve spent the last couple of months preparing the markets for exactly this outcome.

Read More »

Read More »

No Follow-Through Euro Buying while S&P Holds Yesterday’s Breakout

Overview: A quiet consolidative session has been recorded

so far today as North American leadership is awaited. The preliminary PMI

readings are mixed. Japan and the eurozone look somewhat better, but Australia

and the UK disappointed. The dollar is trading with a mostly firmer bias,

but largely confined to yesterday's ranges. The markets seem to be looked

ahead toward next week's Fed, ECB, and BOE meetings, and the return of China

from this...

Read More »

Read More »

With Trepidation, the Market Awaits the BOJ

With the market nearly ruling out a 50 bp hike by the Federal Reserve on February 1, the interest rate adjustment appears to have largely run its course. This may be helping to ease the selling pressure on the greenback.

Read More »

Read More »

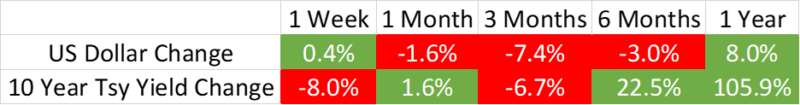

Dollar Index Gives Back Half of 21-Month Gains in 3 1/2 Months

Overview: The continued easing of US price pressures

has strengthened the market's conviction that the Federal Reserve will further

slow the pace of rate hikes and that the terminal rate will be near 5.0%. The

decline in US rates has removed a key support for the US dollar, which has

fallen against all the G10 currencies this week. The Dollar Index has now retraced half of what it gained since bottoming on January 6, 2021. Meanwhile, there are...

Read More »

Read More »

Here are three things you can learn from the Fed

Anyone who has decided to buy gold, or follows the gold price will be aware of how powerful the US Federal Reserve is. This year the Federal Reserve will turn 110 years old, only in recent years is dollar hegemony appearing to falter. Below we look at the central bank’s origins and three lessons we can learn from the history of the world’s most powerful bank, in order to help our investment decisions in 2023.

Read More »

Read More »

Consolidative Tone in FX

Overview: After sharp losses yesterday, the US dollar has stabilized today arguably ahead of Fed Chair Powell's speech at the Riksbank symposium. Yesterday's Fed speakers stuck to the hawkish rhetoric, and this seemed to help reverse the equity market gains, though the greenback remained soft.

Read More »

Read More »

Greenback’s Sell-off may Stall Ahead of Powell Tomorrow

Overview: Don't fight the Fed went the manta as the

market took the US two-year yield back up to 4.50% in the aftermath of the FOMC

minutes last week, the highest in over a month. The minutes warned of a

premature easing of financial conditions. And then bam, softer than expected

hourly earnings and a weak service PMI and bonds and stocks rallied, and the

dollar was sold. This is a key part of the backdrop for this week, for which

several Fed...

Read More »

Read More »

Weekly Market Pulse: The Consensus Will Be Wrong

What’s your outlook for this year? I’ve heard that question repeatedly over the last month and if you’re reading this hoping I’ll let you have a peak at my crystal ball, you’re going to be disappointed. Because I don’t have a crystal ball and neither, I hasten to add, does anyone else in this business.

Read More »

Read More »

US CPI Featured and Why the Fed may Still Hike by 50 bp

The most important economic report in the week ahead is the US December Consumer Price Index on January 12. To be sure, the Federal Reserve targets an alternative measure, the deflator of personal consumption expenditures. However, in this cycle, when households, businesses, investors, and policymakers are particularly sensitive to inflation, CPI, which is reported a couple of weeks before the PCE deflator, has stolen the thunder.

Read More »

Read More »

Yesterday’s Gains Unwound may Make the Greenback a Better Buy Ahead of FOMC Minutes

Overview: Yesterday's greenback gains have been

mostly reversed today. New efforts by China in its property market and

anticipation of more stimulus helped rekindle the animal spirits today. Asia

and Europe shrugged off yesterday's losses on Wall Street and the rally in

bonds continued. The 8-12 bp decline in European benchmark 10-year yields comes

even though the final composite PMI was better than expected fanning hopes of a

short and shallow...

Read More »

Read More »

What Can the Fed tell the Market it Does Not Already Know?

Overview: The softer than expected US CPI drove the

dollar and interest rates lower, while igniting strong advances in equities,

risk assets, commodities, and gold. Calmer market conditions are

prevailing today, and we suspect that in the run-up to the FOMC meeting, a broadly

consolidative tone will emerge. The dollar is mostly softer, but within yesterday’s

ranges. Only the New Zealand and Canadian dollars among the G10 currencies are softer....

Read More »

Read More »

US Federal Reserve Sticks To The Script But For How Long?

2023-02-04

by Stephen Flood

2023-02-04

Read More »