Tag Archive: Global Economy

If Bitcoin Is A Bubble…

Our earlier articles on bitcoin discuss the crypto asset as a currency and a commodity. Both papers focused on the consequences of bitcoin’s defining feature: the asymptotic supply limit of 21 million coins. This gives it an unusual juxtaposition of demand uncertainty and supply certainty (as well as inelasticity). As a currency, it gives rise to a tension between its use as a store of value and as medium of exchange.

Read More »

Read More »

China Exports and Industrial Production: Revisiting Once More The True Worst Case

As weird as it may seem at first, the primary economic problem right now is that the global economy looks like it is growing again. There is no doubt that it continues on an upturn, but the mere fact that whatever economic statistic has a positive sign in front of it ends up being classified as some variant of strong. That’s how this works in mainstream analysis, this absence of any sort of gradation where if it’s negative it’s bad (though in 2015...

Read More »

Read More »

Jim Grant: “Markets Trust Too Much In The Presence Of Central Banks”

James Grant, Wall Street expert and editor of the renowned investment newsletter «Grant’s Interest Rate Observer», warns of the unseen consequences of super low interest rate and questions the extraordinary actions of the Swiss National Bank. Nearly ten years after the financial crisis, extraordinary monetary policy has become the norm.

Read More »

Read More »

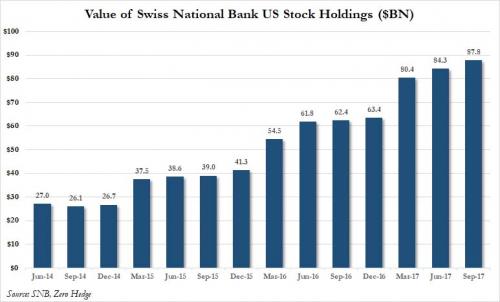

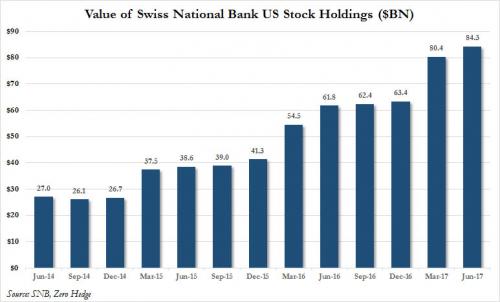

The Swiss National Bank Now Owns A Record $88 Billion In US Stocks

In the third quarter of 2017, one in which the global economy was supposedly undergoing an unprecedented "coordinated growth spurt", and in which central banks were preparing to unveil their QE tapering intentions, in the case of the ECB, or raising rates outright, at the Fed, what was really taking place was another central bank buying spree meant to boost confidence that things are now back to normal, using "money" freshly printed out of thin...

Read More »

Read More »

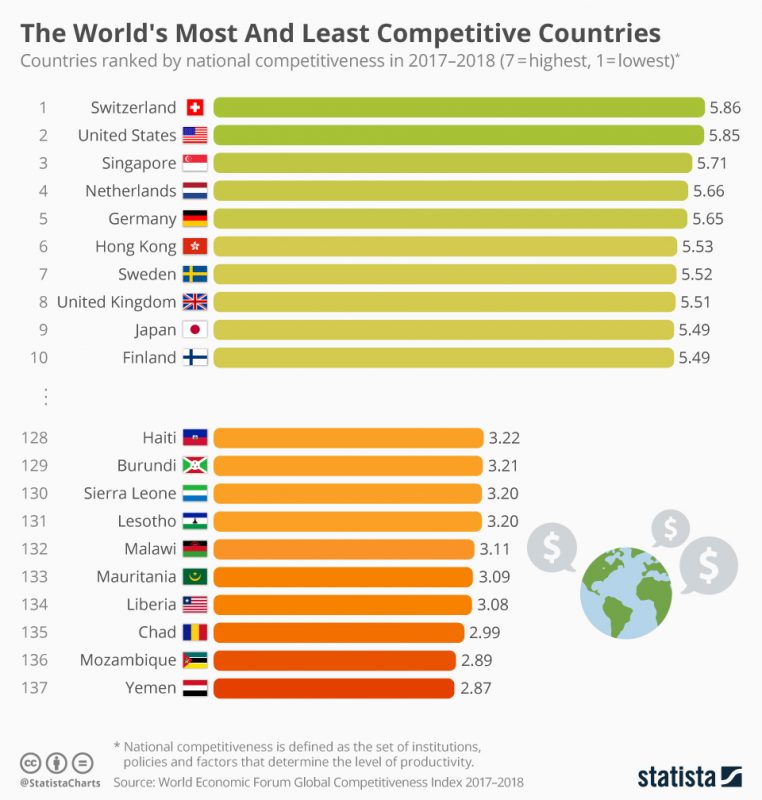

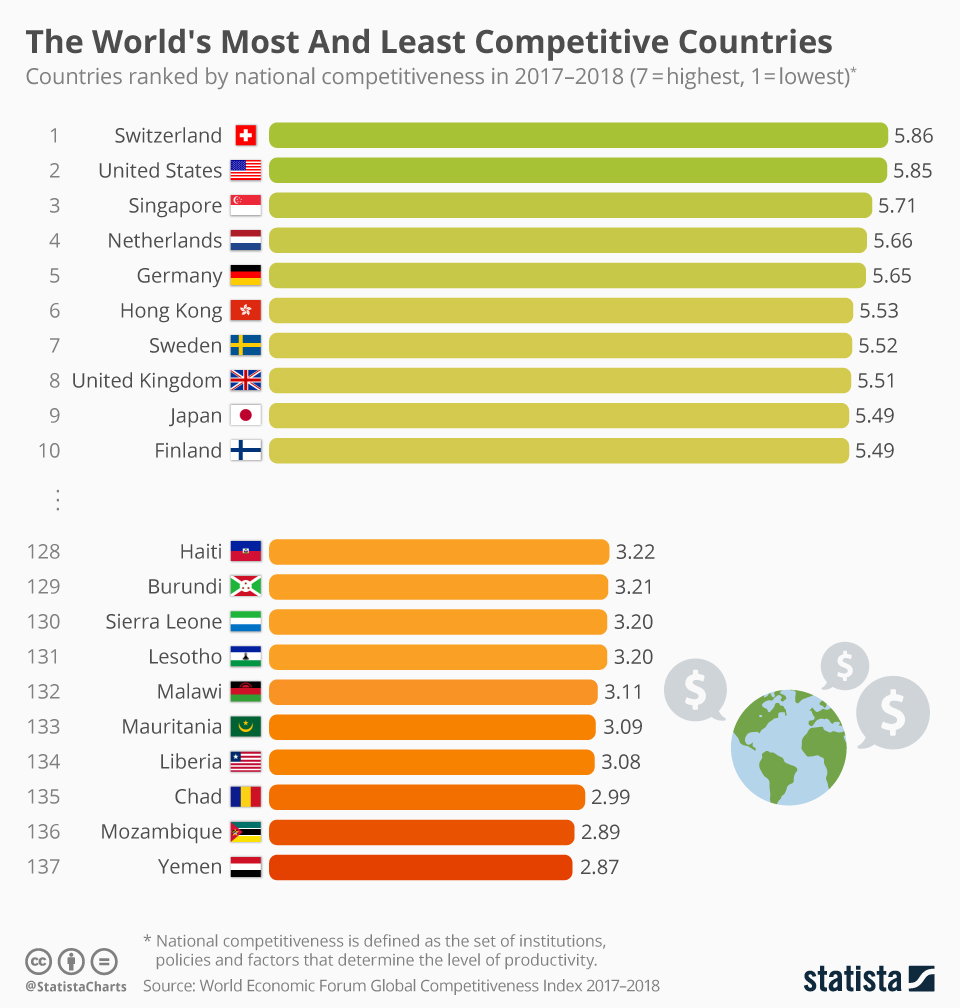

Switzerland Tops World’s Most Competitive Countries Index (Yemen Least)

Something else 'Murica is no longer #1 in... A recently released World Economic Forum report has found that the global economy is recovering well nearly a decade on from the start of the global financial crisis with GDP growth hitting 3.5 percent in 2017. The eurozone in particular is regaining traction with 1.9 percent growth expected this year. As Statista's Niall McCarthy points out, the improvement in Europe's economic fortunes can be seen in...

Read More »

Read More »

Fed’s Asset Bubbles Now At The Mercy Of The Rest Of The World’s Central Bankers

"Like watching paint dry," is how The Fed describes the beginning of the end of its experiment with massively inflating its balance sheet to save the world. As former fund manager Richard Breslow notes, however, Yellen's decision today means the risk-suppression boot is on the other foot (or feet) of The SNB, The ECB, and The BoJ; as he writes, "have no fear, The SNB knows what it's doing."

Read More »

Read More »

“Under Any Analysis, It’s Insanity”: What War With North Korea Could Look Like

Now that the possibility of a war between the US and North Korea seems just one harshly worded tweet away, and the window of opportunity for a diplomatic solution, as well as for the US stopping Kim Jong-Un from obtaining a nuclear-armed ICBM closing fast, analysts have started to analyze President Trump’s military options, what a war between the US and North Korea would look like, and what the global economic consequences would be.

Read More »

Read More »

Chinese Basis For Anti-Reflation?

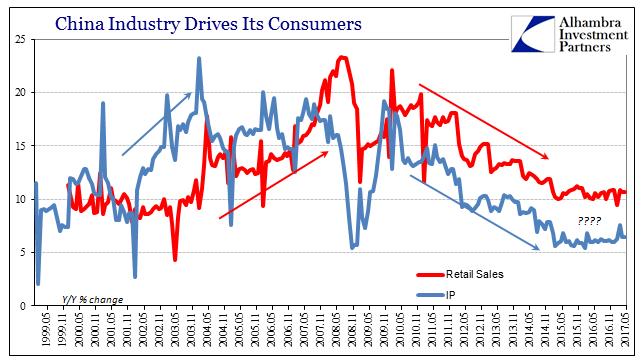

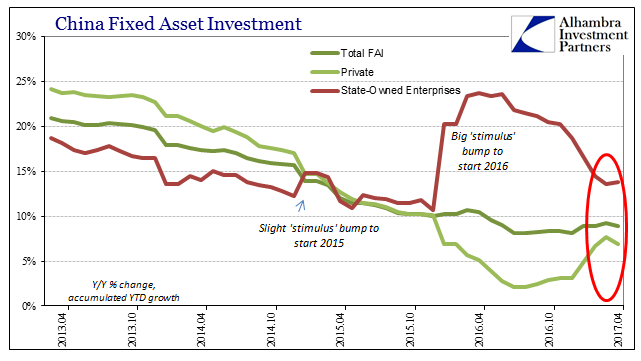

Yesterday was something of a data deluge. In the US, we had the predictable CPI dropping again, lackluster US Retail Sales, and then the FOMC’s embarrassing performance. Across the Pacific, the Chinese also reported Retail Sales as well as Industrial Production and growth of investments in Fixed Assets (FAI). When deciding which topics to cover yesterday, it was easy to leave off the Chinese portion simply because much of it didn’t change.

Read More »

Read More »

Trying To Reconcile Accounts; China

Chinese economic data for April 2017 has been uniformly disappointing. External trade numbers resembled too much commodity prices, leaving an emphasis on them rather than actual economic forces. The latest figures for the Big 3, Industrial Production, Retail Sales, and Fixed Asset Investment, unfortunately also remained true to the pattern.

Read More »

Read More »

Policy Makers – Like Generals – Are Busy Fighting The Last War

The Maginot Line formed France's main line of defense on its German facing border from Belgium in the North to Switzerland in the South. It was constructed during the 1930s, with the trench-based warfare of World War One still firmly in the minds of the French generals. The Maginot Line was an absolute success...as the Germans never seriously attempted to attack it's interconnected series of underground fortresses. But the days of static warfare...

Read More »

Read More »

80 percent Of Central Banks Plan To Buy More Stocks

Regular readers remember how, when we first reported around the time of our launch eight years ago that central banks buy stocks, intervene and prop up markets, and generally manipulate equities in order to maintain confidence in a collapsing system, and avoid a liquidation panic and bank runs, it was branded "fake news" by the established financial "kommentariat."

Read More »

Read More »

Davos Elite Eat $40 Hot Dogs While “Struggling For Answers”, Cowering in “Silent Fear”

For those unfamiliar with what goes on at the annual January boondoggle at the World Economic Forum in Davos, here is the simple breakdown. Officially, heads of state, captains of industry, prominent academics, philanthropists and a retinue of journalists, celebrities and hangers-on will descend Tuesday on the picturesque alpine village of Davos, Switzerland, for the World Economic Forum.

Read More »

Read More »

Davos: In Defense Of Populism

DAVOS MAN: “A soulless man, technocratic, nationless and cultureless, severed from reality. The modern economics that undergirded Davos capitalism is equally soulless, a managerial capitalism that reduces economics to mathematics and separates it from human action and human creativity.” – From the post: “For the Sake of Capitalism, Pepper Spray Davos”

Read More »

Read More »

A Biased 2017 Forecast, Part 1

A couple weeks ago I was lucky enough to see a live one hour interview with Michael Lewis at the Annenberg Center about his new book The Undoing Project. Everyone attending the lecture received a complimentary copy of the book. Being a huge fan of Lewis after reading Liar’s Poker, Boomerang, The Big Short, Flash Boys, and Moneyball, I was interested to hear about his new project.

Read More »

Read More »

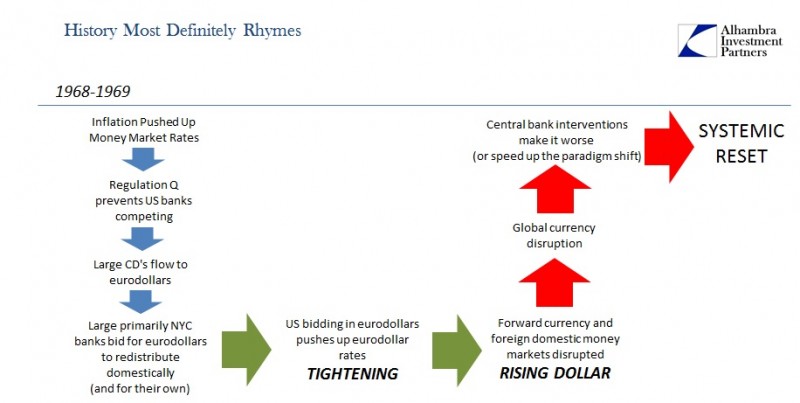

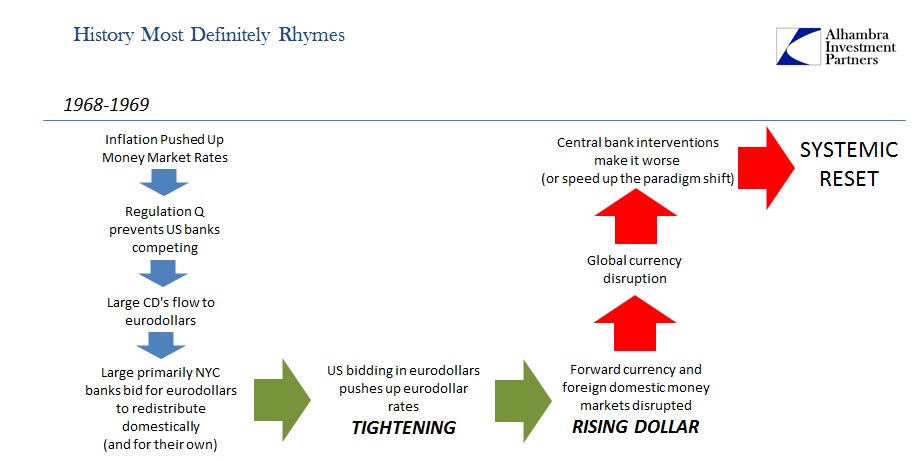

We Know How This Ends – Part 2

In March 1969, while Buba was busy in the quicksand of its swaps and forward dollar interventions, Netherlands Bank (the Dutch central bank) had instructed commercial banks in Holland to pull back funds from the eurodollar market in order to bring up their liquidity positions which had dwindled dangerously during this increasing currency chaos.

Read More »

Read More »

Global Warm-Ongering: What Happens If Trump Takes US Out Of Paris Agreement?

For all the shock, horror, and aghast of global warm-ongers, comes a startling revelation: It’s Irrelevant if US Pulls Out of Paris Accord. Donald Trump has sent his clearest message yet about his plans for reshaping US policy on global warming by choosing a chief environmental regulator who has questioned the science of climate change.

Read More »

Read More »

Cashless Society – Is The War On Cash Set To Benefit Gold?

Cash is the new “barbarous relic” according to many central banks, regulators, and some economists and there is a strong, concerted push for the ‘cashless society’. Developments in recent days and weeks have highlighted the risks posed by the war on cash and the cashless society.

Read More »

Read More »