Tag Archive: Housing

Weekly Market Pulse: A Most Unusual Economy

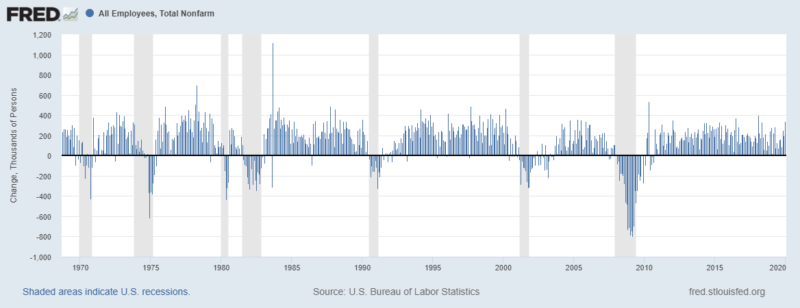

The employment report released last Friday was better than expected but the response by bulls and bears alike was exactly as expected. Both found things in the report to support their preconceived notions about the state of the economy.

Read More »

Read More »

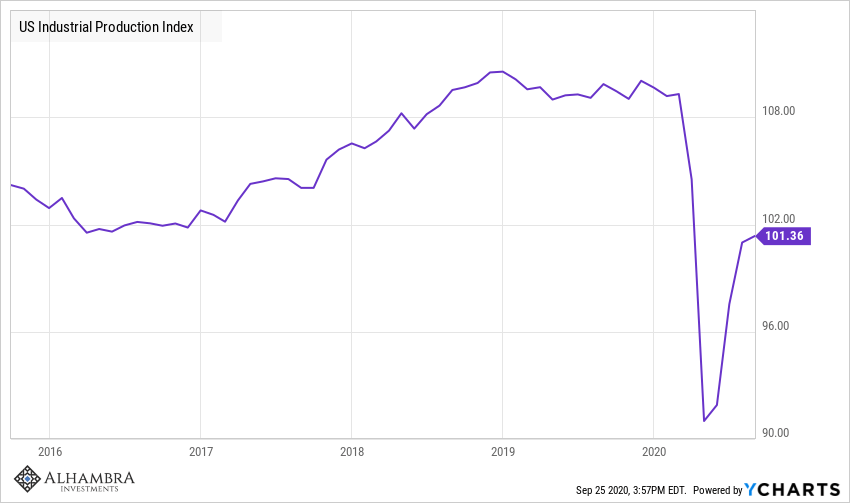

Monthly Macro Monitor – September 2020

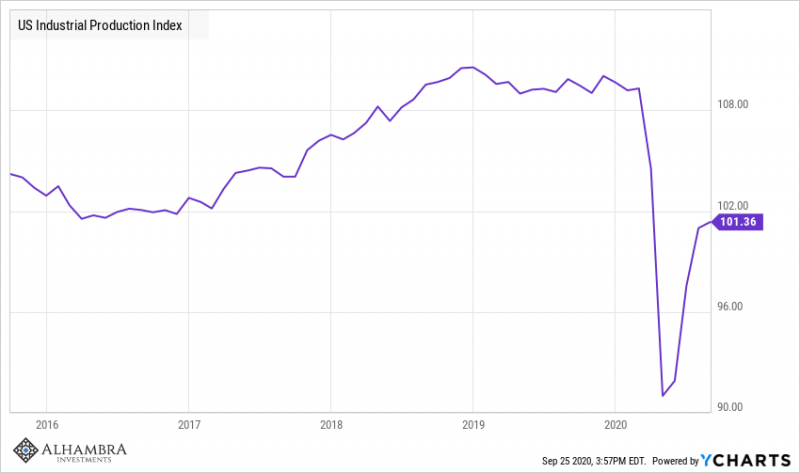

The economic data over the last month continued to improve but the breadth of improvement has narrowed. Additionally, while most of the economic data series are still improving, the rate of change, as Jeff pointed out recently, has slowed. I guess that isn’t that surprising as the initial phase of the recovery comes to an end.

Read More »

Read More »

Downward Home Prices In The Downturn, Too

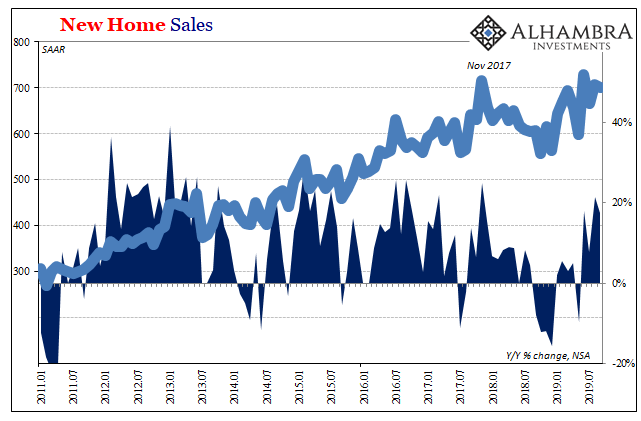

The Census Bureau reported today New Home Sales remained at a better than 700k SAAR in September following the big jump over the previous few months. Though the number was slightly lower last month than the month before, it wasn’t meaningfully less. As discussed yesterday, while that might seem the Fed’s rate cut psychology combined with the bond market’s pessimism (reducing the mortgage rate) is having a positive effect, I don’t see it that...

Read More »

Read More »

Macro Housing: Bargains and Discounts Appear

While things go wrong for Jay Powell in repo, they are going right in housing. Sort of. It’s more than cliché that the real estate sector is interest rate sensitive. It surely is, and much of the Fed’s monetary policy figuratively banks on it. When policymakers talk about interest rate stimulus, they largely mean the mortgage space.

Read More »

Read More »

Monthly Macro Monitor: Doom & Gloom, Good Grief

When I first got in this business oh so many years ago, my mentor told me that I shouldn’t waste my time worrying about the things everyone else was worrying about. As I’ve related in these missives before, he called those things “well worried”. His point was that once everyone was aware of something it was priced into the market and not worth your time.

Read More »

Read More »

Real Estate Perfectly Sums Up The Rate Cuts

It’s only a confusing when you just accept the booming economy of the unemployment rate. From this perspective, 2018 was, and more so 2019 is, a downright conundrum. By all mainstream accounts, this just shouldn’t be happening.

Read More »

Read More »

What Does It Mean That Real Estate, Not Equities, Is Driving Monetary Policy?

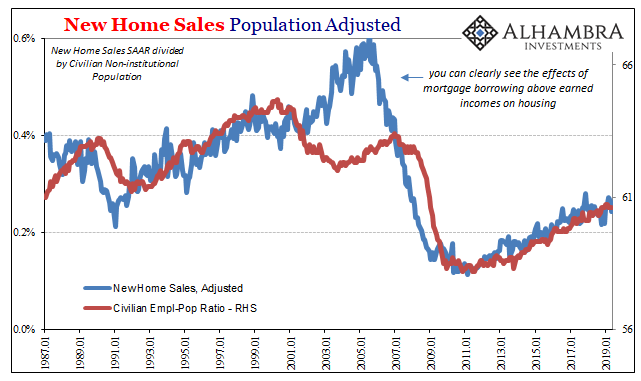

In the world of assets classes, I don’t believe it is equities which hold the Federal Reserve’s attention. After the 2006-11 debacle, the big bust, you can at least understand why policymakers might be more attuned to real estate no matter how the NYSE trades. It may be a decade ago, but that’s the one thing out of the Global Financial Crisis which was seared into the consciousness of everyone who lived through it.

Read More »

Read More »

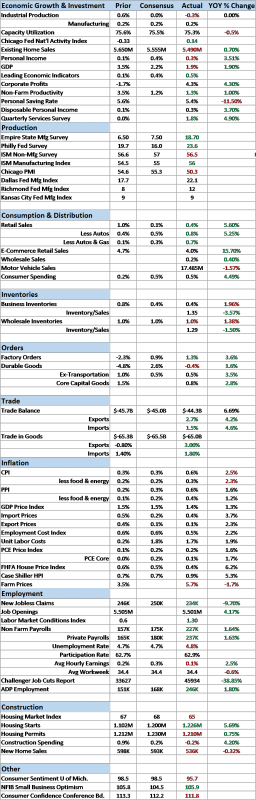

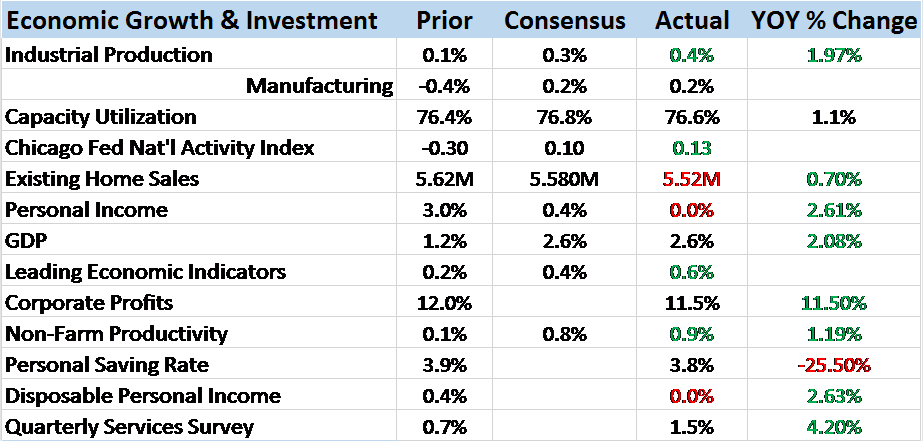

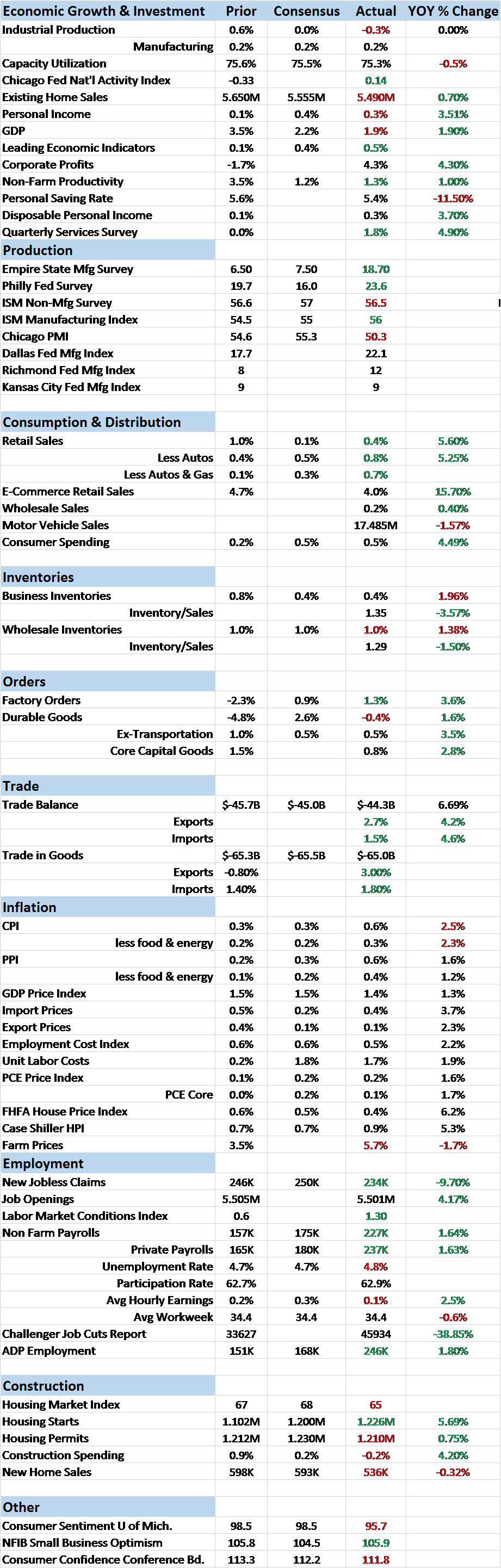

Monthly Macro Monitor: Economic Reports

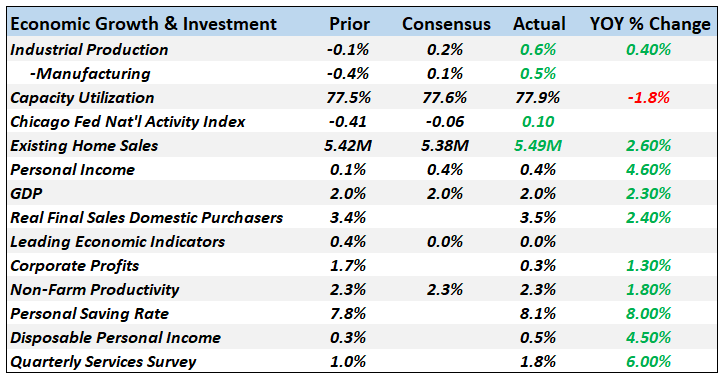

Is recession coming? Well, yeah, of course, it is but whether it is now, six months from now or 2 years from now or even longer is impossible to say right now. Our Jeff Snider has been dutifully documenting all the negativity reflected in the bond and money markets and he is certainly right that things are not moving in the right direction.

Read More »

Read More »

Monthly Macro Chart Review: April 2019

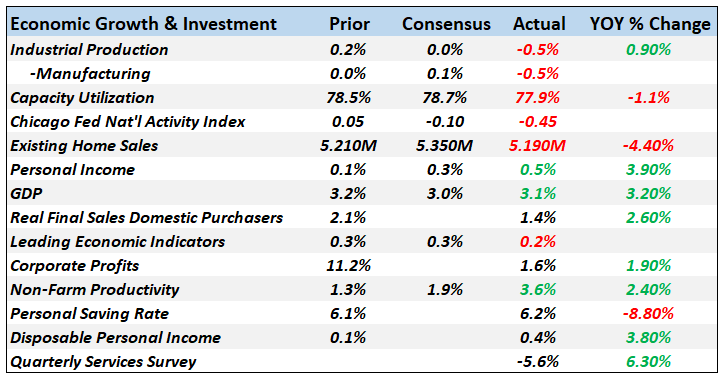

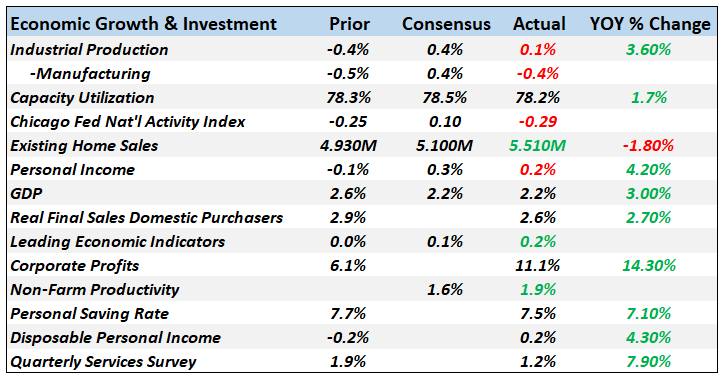

The economic data reported over the last month managed to confirm both that the economy is slowing and that there seems little reason to fear recession at this point. The slowdown is mostly a manufacturing affair – and some of that is actually a fracking slowdown – but consumption has also slowed.

Read More »

Read More »

The Fate of Real Estate

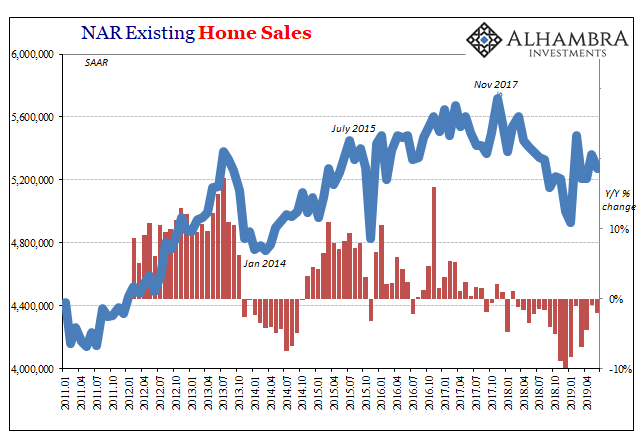

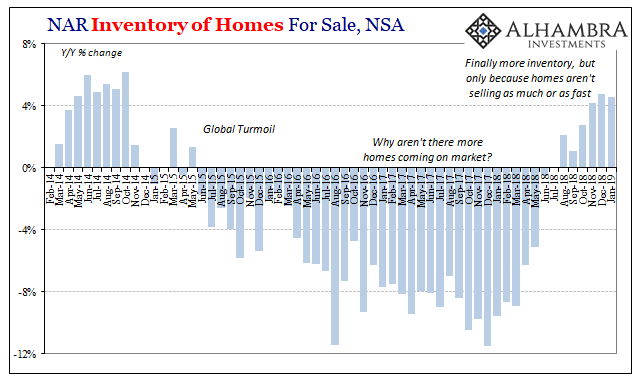

For years, realtors have been waiting for more housing inventory. It had become an article of faith, what was restraining a full-blown recovery was the lack of units available. The level of resales like construction was up, but still way, way less than it was now fourteen years past the prior peak despite sufficient population growth to have absorbed the previous bubble’s overbuilding.

Read More »

Read More »

Monthly Macro Monitor – October 2018

Stocks have stumbled into October with the S&P 500 down about 6% as I write this. The source of equity investors’ angst is always hard to pinpoint and this is no exception but this correction doesn’t seem to be due to concerns about economic growth. At least not directly.

Read More »

Read More »

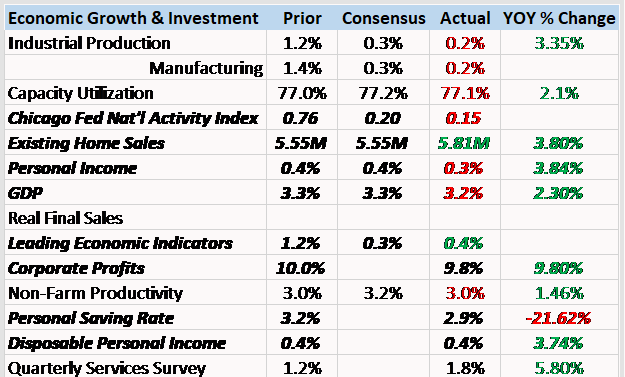

Bi-Weekly Economic Review: Housing Market Accelerates

The economy ended 2017 with current growth just slightly above trend. In general the reports of the last two weeks of the year were pretty good with housing a standout performer going into the new year. We are still trying to get past the impact – positive and negative – from the hurricanes a few months ago though so it is probably prudent to wait for more evidence before making any definitive pronouncements about the economy.

Read More »

Read More »

The Real Estate View For A Second Lost Decade

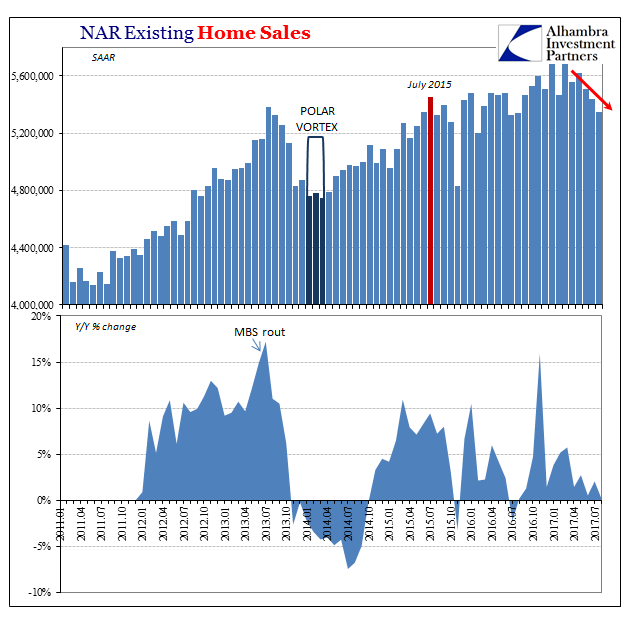

The National Association of Realtor (NAR) reports today that sales of existing homes in the US were down 1.7% in August 2017 from July. At a seasonally-adjusted annual rate of 5.35 million, that’s the lowest pace for resales since July 2016. It is yet another data point reflecting the almost certain end of “reflation” in the economic sense.

Read More »

Read More »

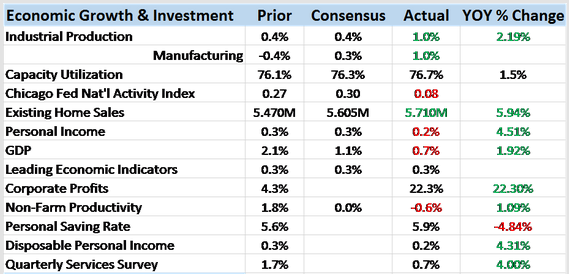

Bi-Weekly Economic Review: Ignore The Idiot

Of the economic releases of the past two weeks the one that got the most attention was the employment report. That report is seen by many market analysts as one of the most important and of course the Fed puts a lot of emphasis on it so the press spends an inordinate amount of time dissecting it.

Read More »

Read More »

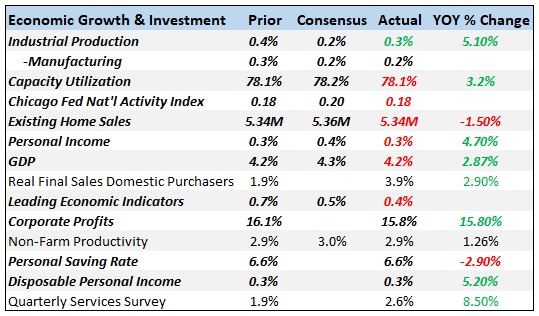

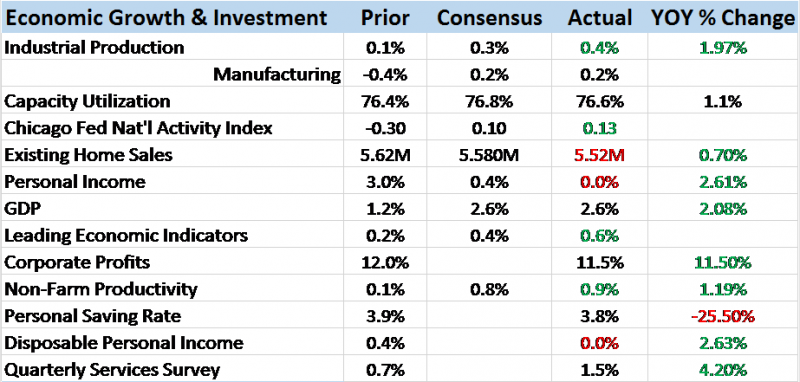

Bi-Weekly Economic Review

The economic data releases since the last update were generally upbeat but markets are forward looking and the future apparently isn’t to their liking. Of course, it is hard to tell sometimes whether bonds, the dollar and stocks are responding to the real economy or the one people hope Donald Trump can deliver when he isn’t busy contradicting his communications staff.

Read More »

Read More »

Bi-Weekly Economic Review

The economic data since my last update has improved somewhat. It isn’t across the board and it isn’t huge but it must be acknowledged. As usual though there are positives and negatives, just with a slight emphasis on positive right now. Interestingly, the bond market has not responded to these slightly more positive readings with nominal and real yields almost exactly where they were in the last update 3 weeks ago. In other words, there’s no reason...

Read More »

Read More »

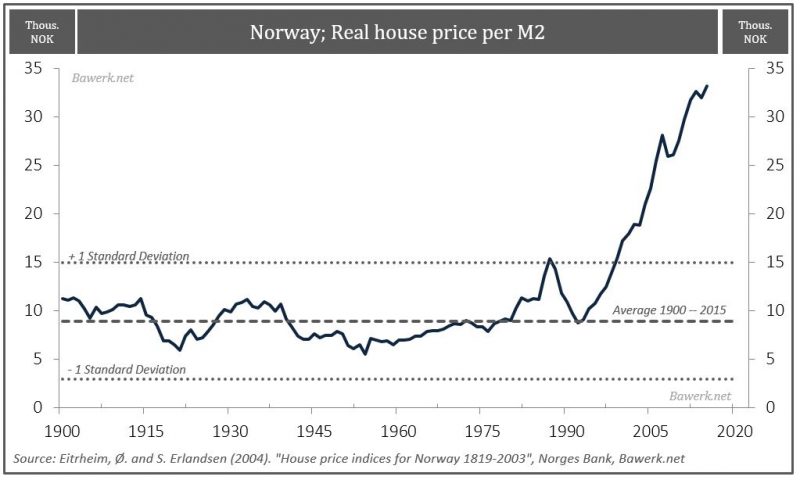

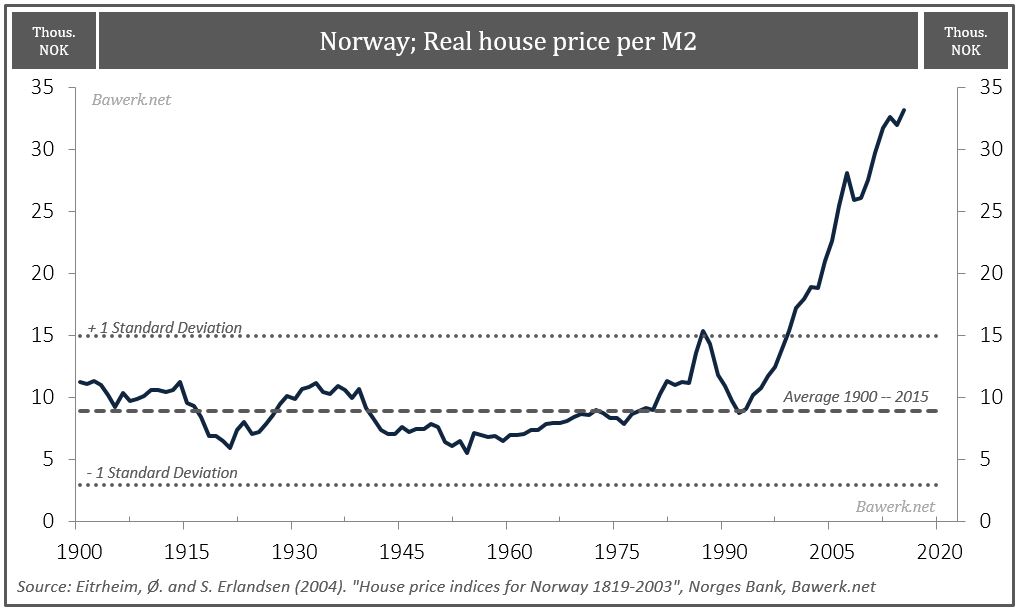

Norway: Towards Stagflation

We have all heard the incredible stories of housing riches in commodity producing hotspots such as Western Australia and Canada. People have become millionaires simply by leveraging up and holding on to properties. These are the beneficiaries of a global money-printing spree that pre-dates the financial crisis by decades.

Read More »

Read More »

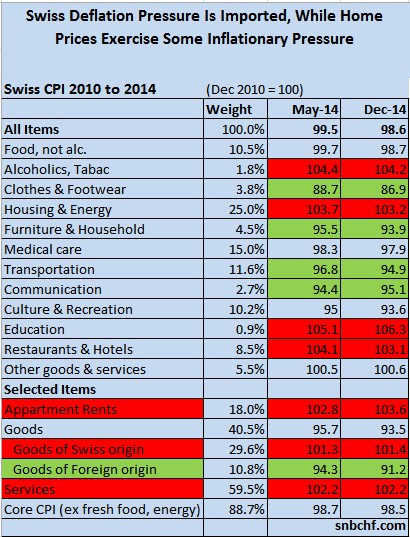

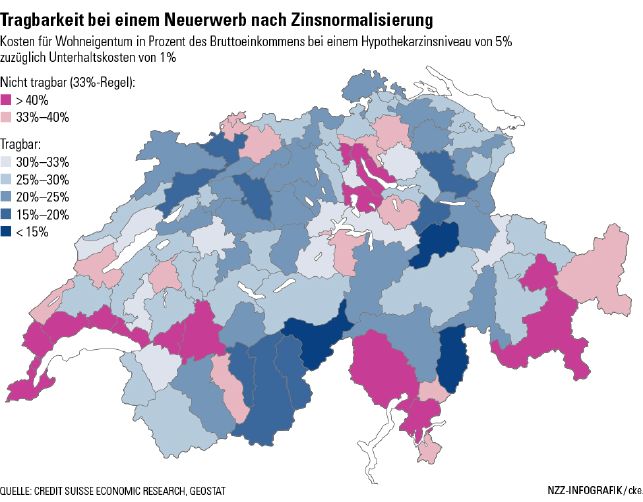

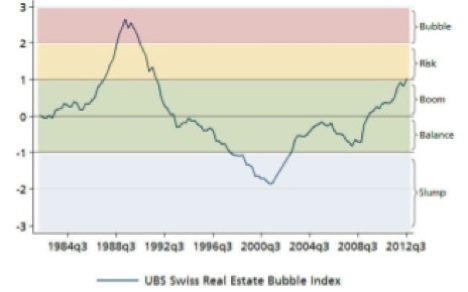

Downwards and Upwards Drivers of Swiss Inflation

In the following we present the drivers of Swiss price inflation. We first present the components of the consumer price index. Then we explain which are upwards-drivers of inflation and which ones cause downwards adjustments.

Read More »

Read More »

Zillow CEO: If You Can, Sell Your U.S. Home Now

Via CNBC Against the backdrop of increasing home prices and the prospect of much higher mortgage rates, it’s a “great time” to sell, Spencer Rascoff, CEO of online real estate marketplace Zillow, told CNBC on Thursday. That is, if you can find a place to buy, he added. “As mortgage rates inevitably come from …

Read More »

Read More »