Tag Archive: inflation

Weekly Market Pulse: Are Higher Interest Rates Good For The Economy?

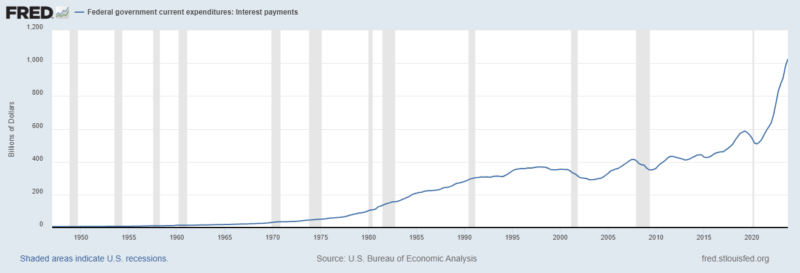

Interest rates surged last week on the back of a hotter-than-expected inflation report that wasn’t actually that bad (see below). Not that my – or your – opinion about these things matters all that much to the market.

Read More »

Read More »

Is gold too expensive to buy right now?

Share this article

This question has been at the center of a great many conversations I’ve been recently having with clients and friends. The way I like to answer it is with another question: Expensive compared to what?

Despite its recent surge to record highs, there are compelling reasons why purchasing gold right now is a prudent decision, with strong indications that its value is poised to climb even higher. Making investment decisions...

Read More »

Read More »

Gold, Oil, and Interest Rates Rise

Overview: The market put more weight on the rise in

the US ISM manufacturing survey than the downward revision to the manufacturing

PMI and the unexpected back-to-back decline in construction spending. US rates

shot up and lifted the greenback. The Dollar Index made a new high for the

year, a little above 105, which had been anticipated by the new lows recorded

by the Bannockburn

World Currency Index (a GDP-weighted basket of the currencies of...

Read More »

Read More »

Dollar Extends Gains Against the Yen but Broadly Firmer Ahead of the FOMC

Overview: The US dollar remains bid ahead of the outcome of today's

FOMC meeting. No change in policy is expected, but the forward guidance, partly

delivered in the updated projections, is the focus. In the last iteration

(December), the Fed "dot" was for three rate cuts this year. Japanese

markets were closed for a national holiday today but dollar's gains against the

yen have been extended and the greenback is nearing the peak seen in...

Read More »

Read More »

Strong US Retail Sales may Help Extend the Dollar’s Recovery

Overview: We have put emphasis on today's US retail sales report. A recovery from the weather-induced weakness in January should underscore the resilience of US demand after another 200k jobs were created and personal income jumped 1%.

Read More »

Read More »

Forex Becalmed with the Greenback Mostly Firmer in Narrow Ranges

(Business trip will interrupt the commentary over the next few days. Check out the March monthly here. Back with the Week Ahead on March 9. May have some comments on X @marcmakingsense.) Overview: Outside of the Australian and New Zealand

dollars, which are off by 0.20%-0.25%, the other G10 currencies are little

changed and mostly softer in narrow ranges. A firm Tokyo CPI, mostly on base

effects and softer rates helped keep the US dollar below...

Read More »

Read More »

Yen Pops on BOJ Comments on Inflation, but the Dollar holds Most of Yesterday’s Gains against the other G10 Currencies

The dollar is mixed as the market awaits the US personal consumption expenditure deflator, which is the measure of inflation the Fed targets. While there is headline risk, we argue that the signal has already been generated by the CPI and PPI releases.

Read More »

Read More »

Japanese Officials Weigh-In and Help Yen Stabilize, while Euro and Sterling Extend Losses

Overview: The market's reaction to the firmer than expected

January CPI seems exaggerated. We do not think it was the game-changer for the

Federal Reserve that the market seemed to think. The dollar was driven higher,

and it is stabilizing today, though the euro and sterling extended their

losses, most of the other G10 currencies did not. After the yen's six-week

slide did not elicit a response from Japanese officials, yesterday's drop did,

and...

Read More »

Read More »

Sterling Buoyed by Labor Market Report Ahead of US CPI

Overview: The US dollar is enjoying a mostly firmer bias ahead

of today's CPI report. Sterling is the strongest among the G10 currencies after

a more resilient than expected labor market report. The dollar extended its

gains against the Japanese yen to a new high since last November, but the

market seems cautious as it approaches JPY150, where large options expire today.

On the other hand, emerging market currencies are mostly faring better. The...

Read More »

Read More »

US Tech Sell-Off Challenges Risk Appetites Ahead of the FOMC

Overview: Ahead of the US Treasury's quarterly

refunding announcement and the outcome of the FOMC meeting, the dollar is

trading higher against all the G10 currencies. With US high-flying tech stocks

posting steep losses after disappointing earnings reports, the currencies most

sensitive to risk-appetites, the dollar bloc and the Norwegian krone are the

weakest. Emerging market currencies are mixed. The South African rand,

Philippine peso, and...

Read More »

Read More »

USD Looks Oversold on Intraday Basis Ahead of a Possible Risk-Off North American Session

Overview: The US dollar is trading lower against most

currencies, but the intraday momentum indicators are stretched, suggesting the

selling pressure may not be sustained through in North America today. December

US personal income and consumption data was contained in yesterday's Q4 23 GDP

data, but the market want to see the monthly print, which is expected to see

the core measure ease with the headline rate flat. Tokyo's January CPI was much...

Read More »

Read More »

China Data Dump Keeps Market Looking for a Rate Cut Next Week

Overview: The mostly consolidative week for the US dollar

continues. Most for the G10 currencies are +/- about 0.25% today and only a

slightly wider range for the week. The odds of a Fed rate cut in March is

virtually unchanged on the week at around 75%. The JP Morgan Emerging Market

Currency Index is practically flat on the day and week. The Russian ruble and

Mexican peso lead today's advancers, while eastern and central European

currencies are...

Read More »

Read More »

Can the US CPI Break the Dollar out of its Consolidation?

Overview: Stocks and bonds are

trading higher, and the dollar is narrowly mixed ahead of the December US CPI

report. Most of the large bourses in Asia Pacific advanced, led by Japan to new

30-year-plus highs. Hong Kong's Hang Seng snapped seven-day slide to post its

first gain of 2024. Europe's Stoxx 600 is up about 0.33%, to recoup most of its

losses in the past two sessions. US index futures enjoy a modest upside bias.

Benchmark 10-year yields in...

Read More »

Read More »

Consolidation Featured

Overview: After dramatic intraday price swings after

the US jobs data and service ISM figures before the weekend, the dollar is

consolidating today in mostly narrow ranges. The prospect for a March cut by

the Federal Reserve finished last Friday virtually unchanged (73% vs 70%) and

is about 66% chance today. There was interest in Dallas Fed's Logan's

suggestion that the tapering of QT be discussed, though it seems to simply

confirm what many has...

Read More »

Read More »

2023: A year in review

After the catastrophic covid crisis of 2020 and 2021, the extremely impactful and consequential Russian invasion of Ukraine in 2022, many hoped that 2023 would break this terrible bad spell and finally present us all with some hope, economically, geopolitically, socially, technologically. Unfortunately, it only offered further reasons for serious concerns on all these fronts.

Economically, even though the official inflation rate followed a...

Read More »

Read More »

Soft US CPI Today Paves Way for Fed Pivot Tomorrow

Overview: The US dollar is trading softer against all the

G10 currencies ahead of what is expected to be a soft November CPI report,

which paves the way for a pivot by the FOMC tomorrow. It is expected to signal

that policy may be sufficiently restrictive and anticipate being able to cut

rates next year more than it thought in September, even if not as much as is

priced into the market. Among emerging market currencies, central European

currencies...

Read More »

Read More »

The Yen Stabilizes in a Broad Range but the Focus is on Today’s US Employment Report

Overview: The US dollar is a little firmer ahead of

the November employment data. It is trading mostly inside yesterday's range. It

is in a wide range against the Japanese yen (~JPY142.50-JPY144.50) even if not

as wide as yesterday (~JPY141.70-JPY147.30). The Canadian and Australian

dollars are the strongest among the G10 currencies, while the South Korean won,

and Taiwanese dollar are the best performers among the emerging market complex.

Gold,...

Read More »

Read More »

Softer Tokyo CPI Buys BOJ Time while Moody’s Cuts the Outlook for China’s Debt following Fiscal Stimulus and the Continued Property Slump

Overview: Outside of the Australian dollar, which

has fallen by around 0.6% following the RBA meeting and the softer final PMI,

which may have dragged the New Zealand dollar a lower by around 0.25%, the

other G10 currencies trading little changed ahead of the start of the North

American session. The eurozone and UK final PMIs were revised higher. Central

European currencies lead the emerging market currencies. China reported better

than expected...

Read More »

Read More »

The Dollar is Having One of Its Best Days This Month

Overview: After being bludgeoned, the dollar

is having one of its best days of the month. It is rising against all the major

currencies. The Dollar Index is up about 0.5%, which is the most since the end

of October. The greenback is also firmer against all the emerging market currencies

but the Turkish lira and Russian ruble. Some of the demand for the dollar may

be a function of month end, but also the disappointing Chinese PMI, revisions

that...

Read More »

Read More »