Tag Archive: Rating

Swiss National Bank: Composition of Reserves (Assets) and Investment Strategy

The Q1/2016 update on the SNB investment strategy and its assets.

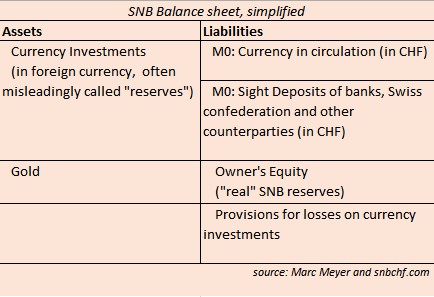

The Swiss National Bank is a passive conservative investor. As opposed to other investors, the exposure in currencies is as important as the strategic asset allocation according asset classes (bonds, equities, cash, real estate). The importance of currencies is one reason why the SNB is often called a hedge fund, the second the volatility of gains and losses.

Read More »

Read More »

SNB Q2/2013 Composition of Reserves

We regularly publish the SNB asset structure by currency, rating & duration, they might be a template for the tactical asset allocation in these dimensions (CHF certainly excluded) for other fixed income and/or rather conservative asset managers. here the newest data Total Balance Sheet and Liabilities The total balance sheet size decreased from 511 bln. …

Read More »

Read More »

SNB Q1 Results: Bottom-Fishing Cheap Yen, Increases Equity Share with Gains and Margin Debt

We regularly publish the SNB asset structure by currency, rating & duration, they might be a template for the tactical asset allocation in these dimensions (CHF certainly excluded) for other fixed income and/or rather conservative asset managers. Composition of SNB Forex Reserves, Q1/2013 With the strong results of 11.2 billion francs, the SNB reduced the …

Read More »

Read More »

Composition of SNB Reserves Q4, 2012, Yield on Investment

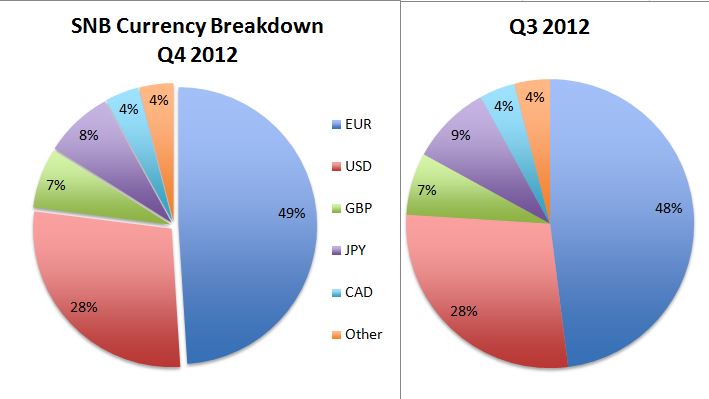

We regularly publish the SNB asset structure by currency, rating & duration, they might be a template for the tactical asset allocation in these dimensions (CHF certainly excluded) for other fixed income asset managers. Moreover we publish the yield on investment. Composition of SNB Forex Reserves, Q4 2012 The Swiss National Bank (SNB) saw …

Read More »

Read More »

Trade Like a Central Bank: Buy EUR/USD at 1.24 and sell at 1.30! .. SNB

Composition of SNB Forex Reserves, Q3 2012 The Swiss National Bank (SNB) reduced the share of euros in the third quarter substantially from 60% in Q2 to 48% in Q3 and increased dollar and pound positions. The SNB bought 80 billion euros or more when the common currency was trading around 1.24$, especially at the end of …

Read More »

Read More »

Did the SNB Front-Run ECB Decisions Far Ahead of Hedge Funds?

We think that the Swiss National Bank invested far more in Italian and Spanish bonds than analysts like Standard and Poor’s expected and was able to front-run ECB decisions. This new style of hedge funds, formerly called “central banks”, can refinance at zero percent and is able to show a lot better performance than the …

Read More »

Read More »

Is Standard and Poor’s a Rating Agency or a Rumor Agency ?

Standard and Poor’s critique of the Swiss National Bank, Part 2, extracts from our full report As many readers of our blog know, we are not the best of friends with the current Swiss National Bank (SNB) policy: we recently published a paper claiming that the SNB will go bankrupt and …

Read More »

Read More »

Donate to SNBCHF.com

Donate to SNBCHF.com Via Paypal or Bitcoin To Help Keep the Site Running

Please consider making a small donation to Snbchf.com. Thanks

Bitcoin wallet: bc1qa2h6hgd0xkuh7xh02jm5x25k6x8g7548ffaj3j

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

USD/CHF stays above 0.9100 nearing the highs since October

4 days ago -

SNB Sight Deposits: increased by 17.0 billion francs compared to the previous week

4 days ago -

Pound Sterling falls back as upbeat US Retail Sales strengthen US Dollar

5 days ago -

Canadian Dollar remains vulnerable after strong US Retail Sales

5 days ago -

2024-04-09 – Martin Schlegel: Interest rates and foreign exchange interventions: Achieving price stability in challenging times

11 days ago

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: increased by 17.0 billion francs compared to the previous week

4 days ago -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

Gold Buying Ramps Up Globally, but Silver Could Get Interesting

Gold Buying Ramps Up Globally, but Silver Could Get Interesting -

Boost Your Savings: Strategies for the Accumulation and Distribution Phases

Boost Your Savings: Strategies for the Accumulation and Distribution Phases -

Blackrock – Fluch oder Segen?

Blackrock – Fluch oder Segen? -

Biden Perpetuates Washington’s Idiotic Steel Trade Policies

-

4-19-24 Did You Pay Your Fair Share of Taxes?

4-19-24 Did You Pay Your Fair Share of Taxes? -

Swiss Fintech Awards 2024 Announce Top 10 Swiss Fintech Startups

Swiss Fintech Awards 2024 Announce Top 10 Swiss Fintech Startups -

Robeyns Peter to Pay Paul

-

FDR’s War Against Civil Liberties

-

Carl Menger Explains Caitlin Clark’s “Low” Rookie Salary and Her Monetized Popularity

-

Gross Domestic Income Shows America Is In Stagnation

More from this category

SNB Sight Deposits: increased by 17.0 billion francs compared to the previous week

SNB Sight Deposits: increased by 17.0 billion francs compared to the previous week16 Apr 2024

- REIT Return and Dividend Yield

11 May 2020

- Gewinnerzielung 2019

28 Feb 2019

- Cookie policy

24 May 2018

- Privacy Policy

18 May 2018

- Repo and Repo Markets

23 Mar 2018

- Investor Relations

28 Feb 2018

The Secret History Of The Banking Crisis

The Secret History Of The Banking Crisis14 Aug 2017

- 100 Years Ago, Russian Stocks Had A Very Bad Day

28 Mar 2017

If It Didn’t Abandon The Gold Standard, U.S. Empire Would Have Collapsed…

If It Didn’t Abandon The Gold Standard, U.S. Empire Would Have Collapsed…19 Feb 2017

Sound Money and Your Personal Finances

Sound Money and Your Personal Finances24 Jan 2017

Pension Funds Need Gold before It’s Too Late

Pension Funds Need Gold before It’s Too Late19 Jan 2017

Rich Middle Class, Poor Middle Class

Rich Middle Class, Poor Middle Class15 Dec 2016

200 Russian Propaganda Sites, or simply alternative media?

200 Russian Propaganda Sites, or simply alternative media?10 Dec 2016

Italian Euro Exit: Why it Might Come in some Years and Why it Will Help the Euro Zone and Italy

Italian Euro Exit: Why it Might Come in some Years and Why it Will Help the Euro Zone and Italy5 Dec 2016

Net National Savings Rate, the Best Alternative Indicator to GDP Growth

Net National Savings Rate, the Best Alternative Indicator to GDP Growth4 Dec 2016

Introducing Yield Purchasing Power, the Video

Introducing Yield Purchasing Power, the Video26 Oct 2016

50 Slides for Gold Bulls – The Full Chart Book

50 Slides for Gold Bulls – The Full Chart Book25 Oct 2016

- Fragenkatalog für Privathaftpflichtversicherungen

8 Oct 2016

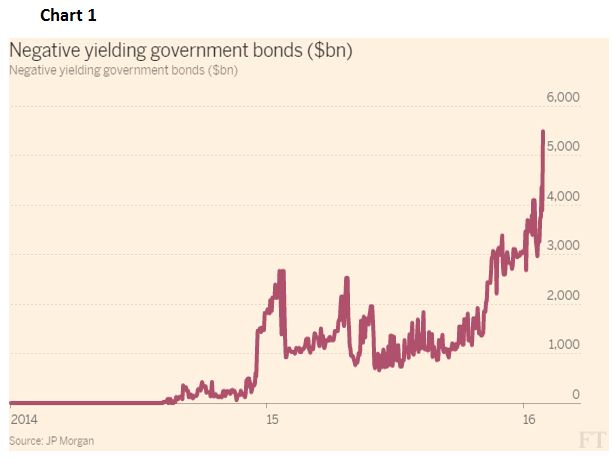

Understanding Negative Interest Rates

Understanding Negative Interest Rates1 Oct 2016