Tag Archive: Seigniorage

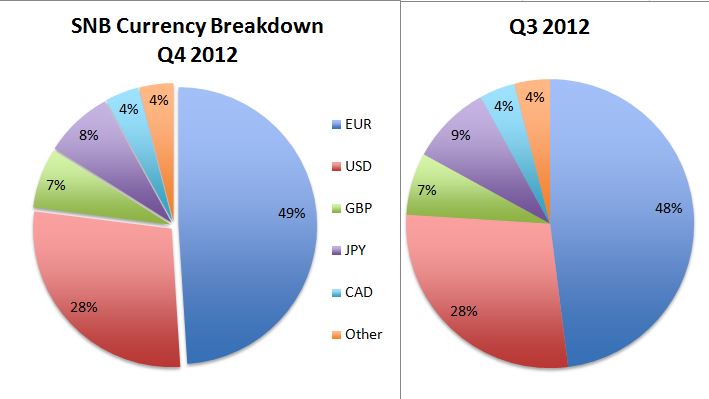

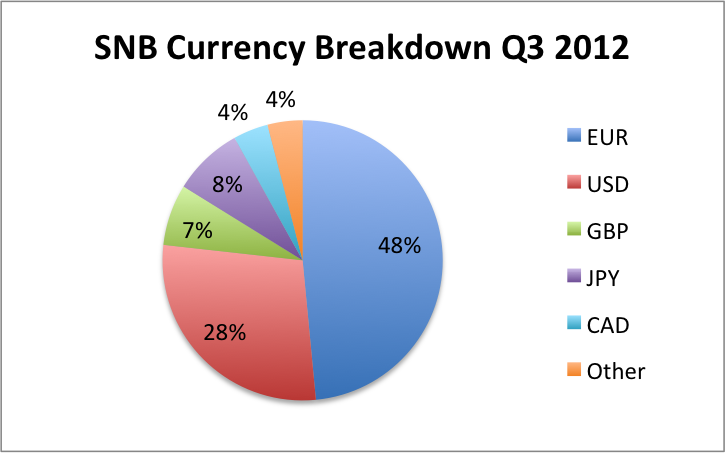

SNB Results Q3 2012: SNB Radically Reduces Euro Share from 60% to 48%

SNB Q3 Profits: 10 billion francs The Swiss National Bank (SNB) radically reduced its euro share, in the third quarter from 60% to 48%, and bought US dollars and sterling instead. In the second quarter, however, it increased the euro share from 51% to 60% and concentrated on buying euros. Given that the EUR/USD was … Continue reading...

Read More »

Read More »

SNB Results: SNB poised for 10 billion CHF quarterly profit

On July 31st the Swiss National Bank will publish interim results for the second quarter 2012. Already now we offer an estimate to our readers. Our estimate does not cover the central bank’s Forex trading results, they are difficult to estimate. A central bank is not a day trader, therefore the influence should be limited. …

Read More »

Read More »