Tag Archive: SNB Gold Holdings

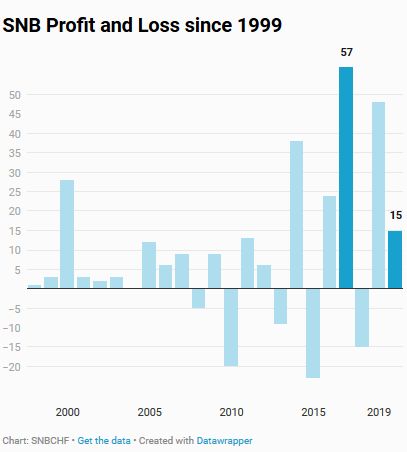

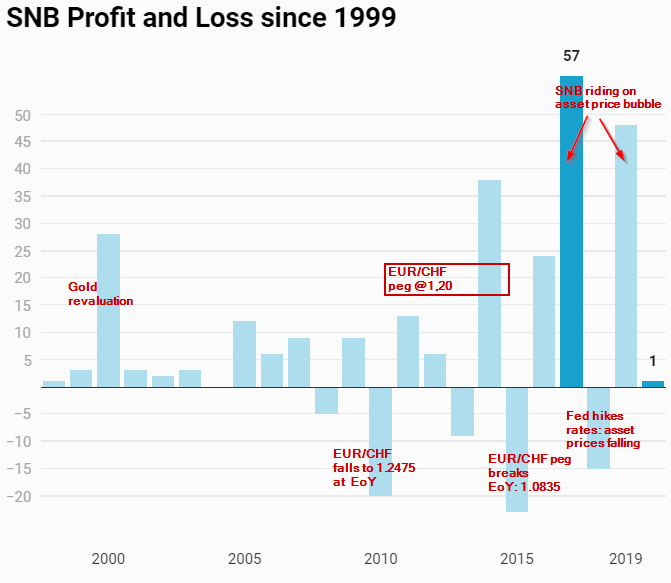

Swiss National Bank Results Q3 / 2016: Volatility of Results is Increasing

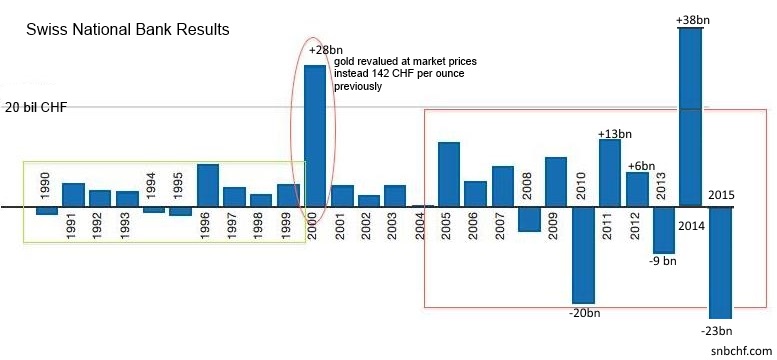

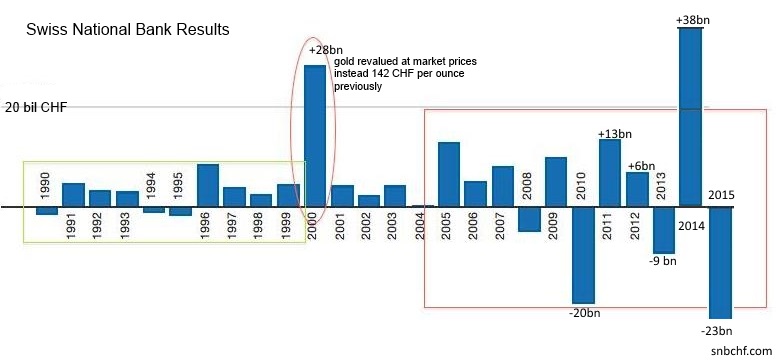

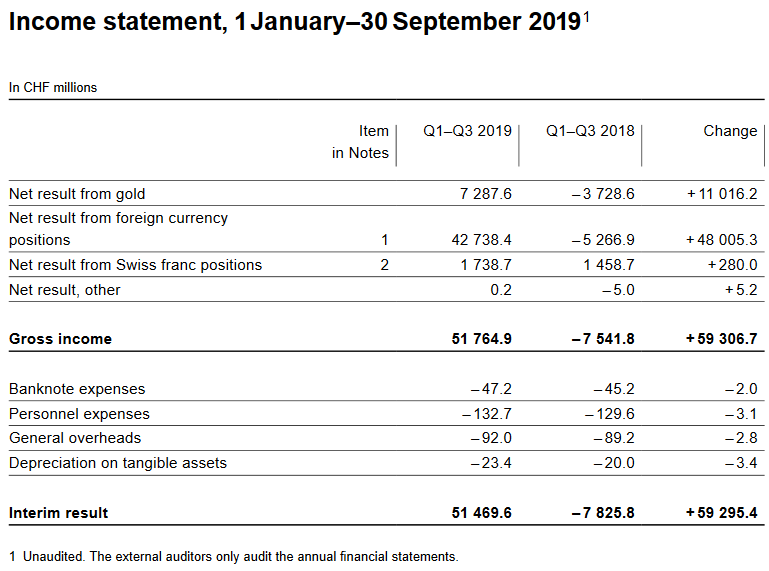

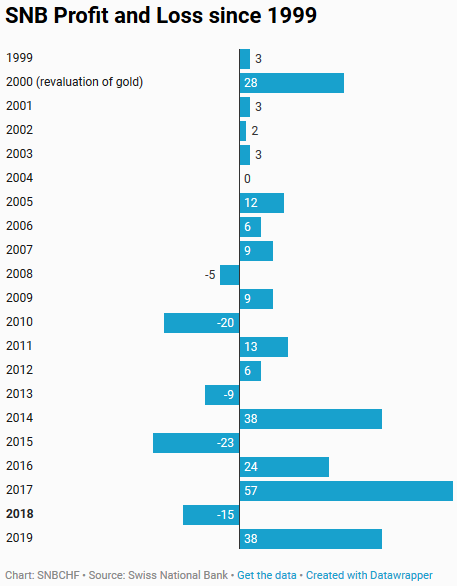

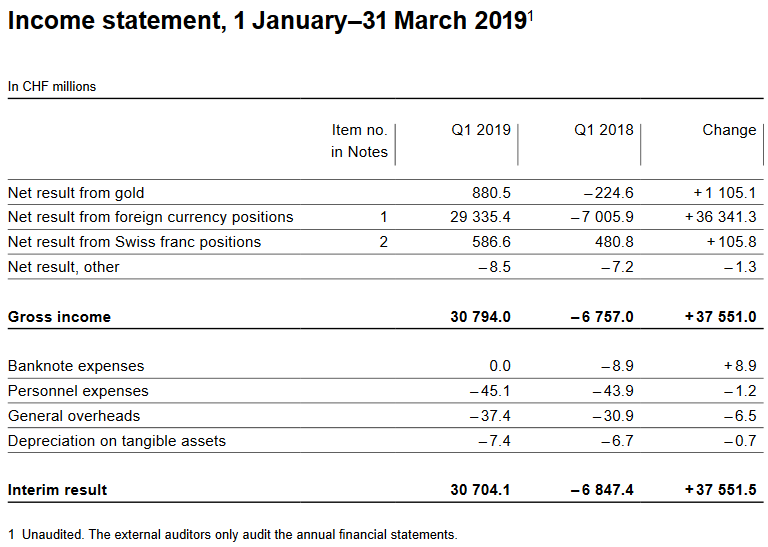

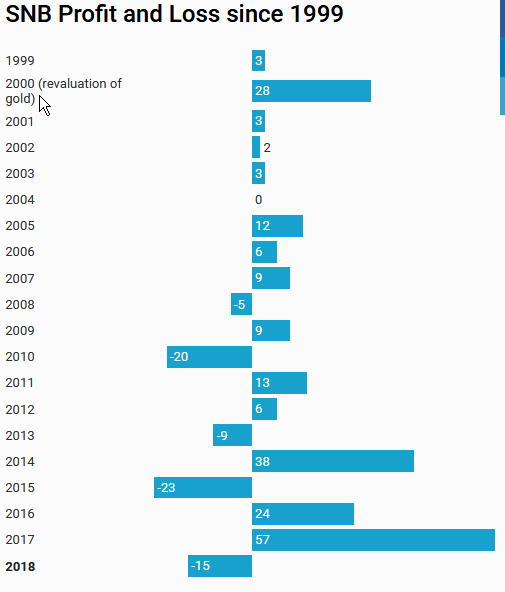

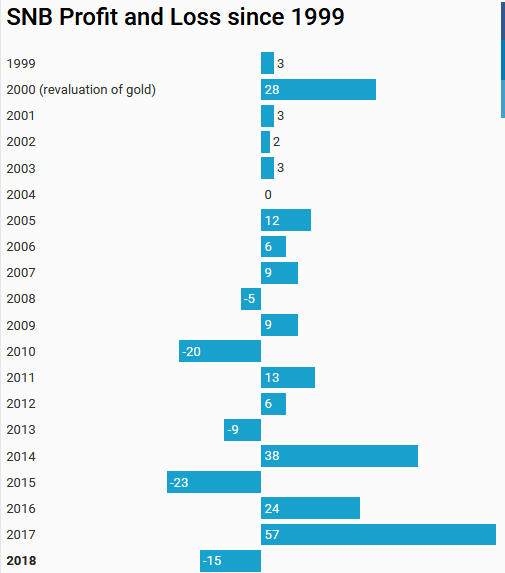

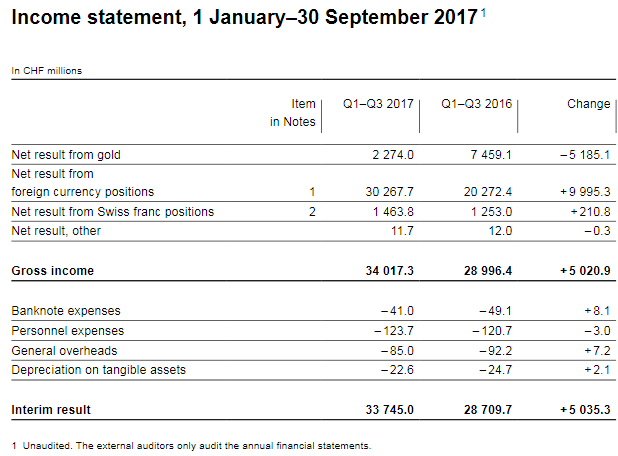

Interim results of the Swiss National Bank as at 30 September 2016 The Swiss National Bank (SNB) reports a profit of CHF 28.7 billion for the first three quarters of 2016. But the volatility is rising: The SNB may lose 50 billion in one year and win 60 billion in the next year or the opposite.

Read More »

Read More »

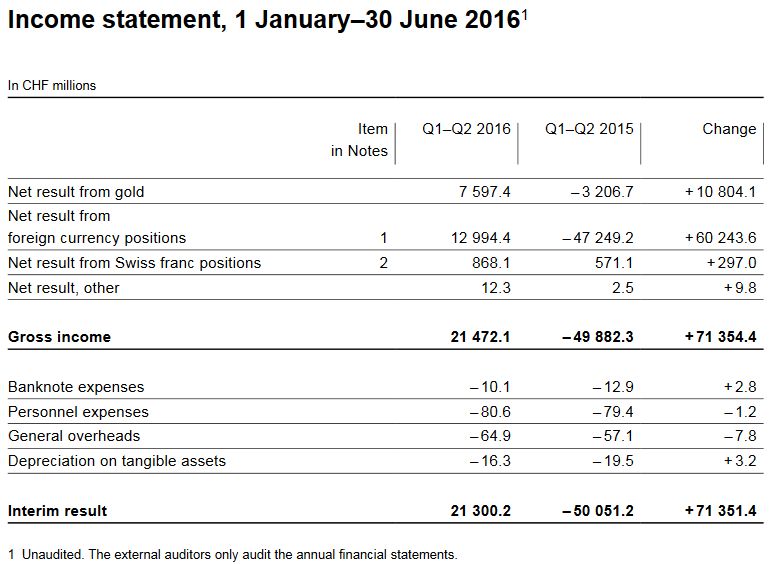

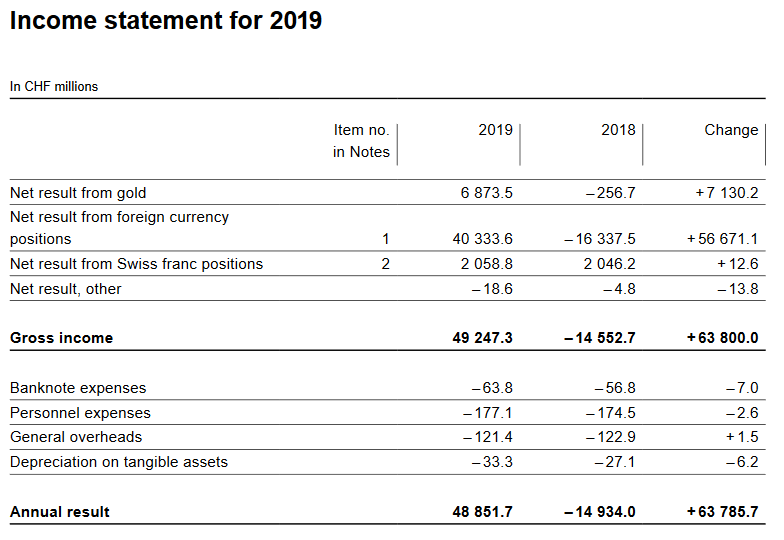

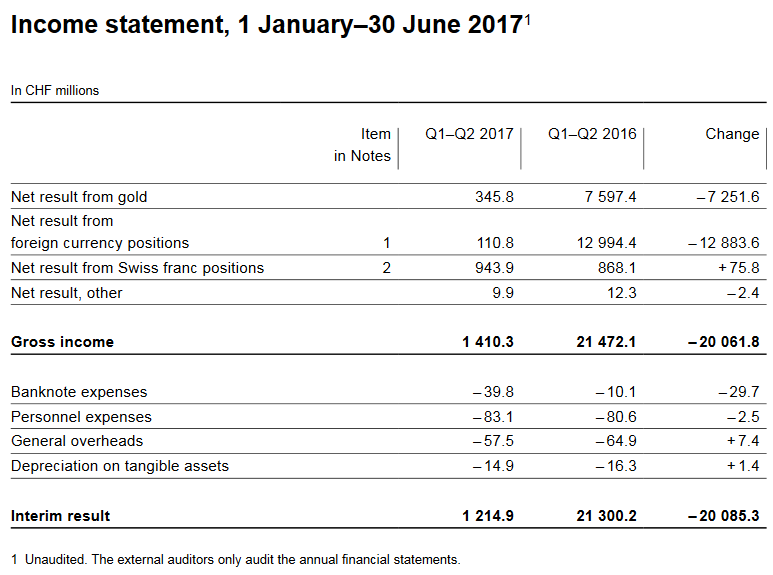

Interim results of the Swiss National Bank as at 30 June 2016

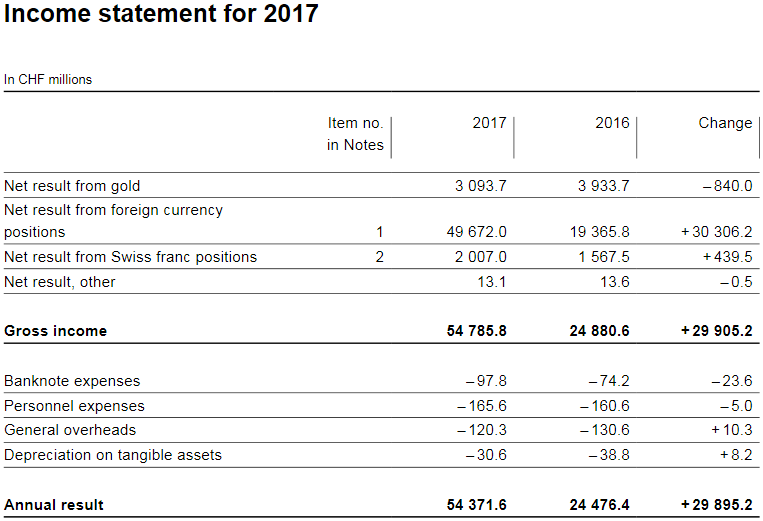

The Swiss National Bank (SNB) reports a profit of CHF 21.3 billion for the first half of 2016. A valuation gain of CHF 7.6 billion was recorded on gold holdings. The profit on foreign currency positions amounted to CHF 13.0 billion.

Read More »

Read More »

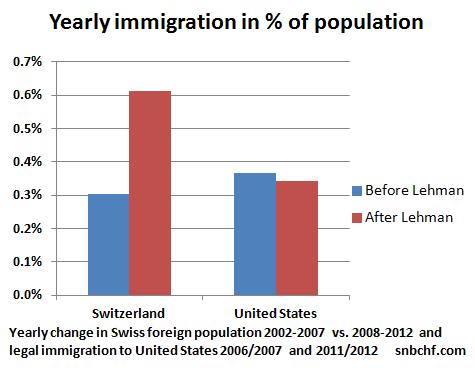

The relationship between CHF and gold

Many people think that Switzerland is related to gold due to its inflation-hedging safe-haven status. Historically this is true. With rising U.S. inflation in the 1970s gold appreciated to record-highs. So did the German Mark and even more the Swiss franc, that maintained low inflation levels.

Read More »

Read More »

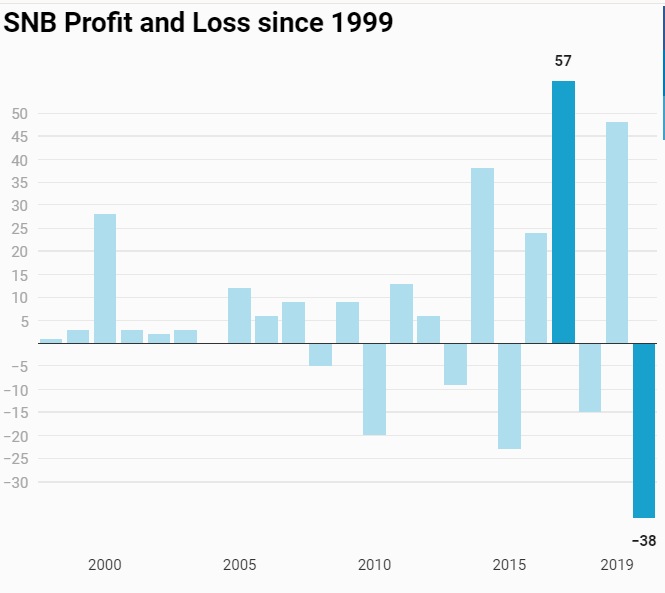

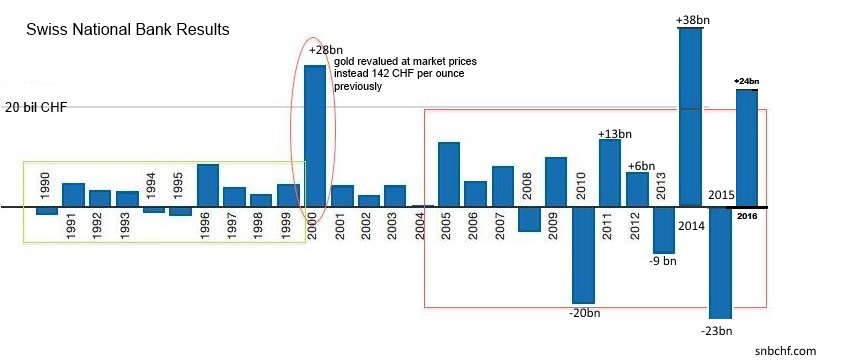

Swiss National Bank Results 2015 and Comments

The Swiss National Bank (SNB) is reporting a loss of CHF 23.3 billion for the year 2015 (2014: profit of CHF 38.3 billion). The loss on foreign currency positions amounted to CHF 19.9 billion. A valuation loss of CHF 4.2 billion was recorded on gold holdings. The profit on Swiss franc positions was CHF 1.2 billion.

Read More »

Read More »

Swiss Franc History: The Gold Standard and Bretton Woods

In this post we will show the history of the Swiss Franc until 1971, a monetary era driven by the gold standard and the Bretton Woods period, both periods with nearly fixed exchange rates.

Read More »

Read More »

2014 Results: SNB expects profit of CHF 38 billion

The Swiss National Bank reported a profit of CHF 38 billion for the year 2014. They obtained price gains in all asset classes, in bonds, stocks and gold. Interest payments and dividends achieved a yield of 1.7%.

Read More »

Read More »

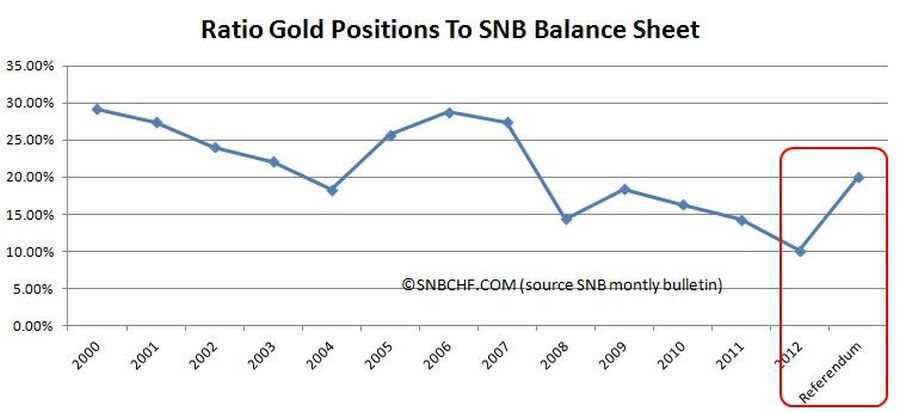

Swiss Gold Referendum and SNB’s Opinion: An Exchange of Arguments

Already in 2013, the Swiss National Bank (SNB) spoke out against the gold initiative and revealed that the Swiss gold is stored mostly in Switzerland and 20% in the UK and 10% in Canada. There is no Swiss gold in the United States according to SNB chairman Jordan. In this post we provide an exchange of Jordan's arguments against the ones of the gold initiative. We also state our view that is not as strict as the one of the referendum proponents.

Read More »

Read More »

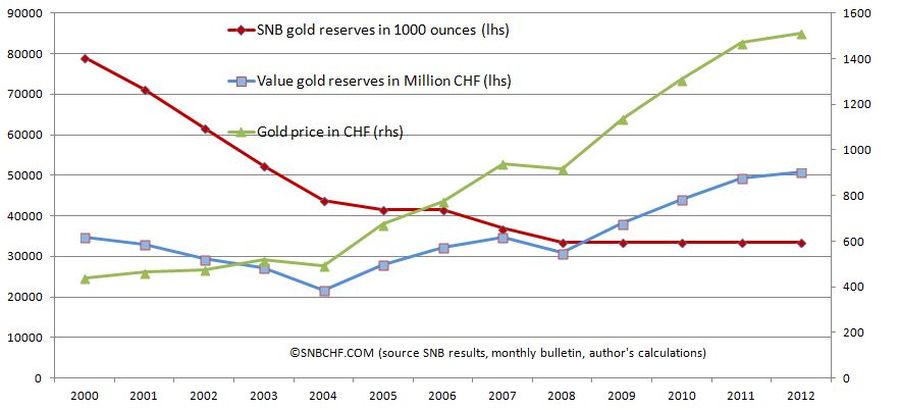

Swiss Franc History, 2000-2007: The sale of the Swiss gold reserves

A critical Swiss Franc History: Between 2000 and 2007, the SNB made the Swiss cantons happy and delivered some billions of francs to prop up their finances. The gains were unfortunately not caused by strong asset management capabilities, but mostly due to gold price improvements and gold sales at quite cheap prices.

Read More »

Read More »

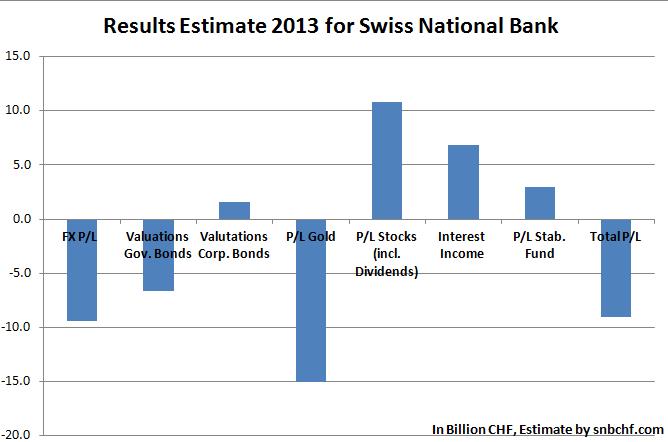

2013 SNB’s Valuation Gains 14 billion CHF on Stocks, but Losses of 35 bln. on Gold, FX and Bonds

The Swiss National Bank (SNB) is reporting a loss of CHF 9.1 billion for the year 2013 (2012: profit of CHF 6.0 billion). Valuation losses on gold holdings amounting to some CHF 15.2 billion contrast with a profit of CHF 3.1 billion on foreign currency positions and a net result of CHF 3.4 billion from …

Read More »

Read More »

SNB Q1/2014 Results: 1.7% annualized Yield on Seigniorage, 2% annualized Loss on FX Rate Change

The main task of a central bank occupied with QEE (quantitative easing or exchange intervention) is to obtain higher gains on seigniorage than it loses with its "ever appreciating" currency. Otherwise its equity capital would be absorbed.

Read More »

Read More »

15 Billion SNB Losses on Gold in 2013, But 40 Billion SNB Profit on Gold between 2000 and 2012

For anybody complaining about gold that caused the big loss of the Swiss National Bank. Since 2000, the total SNB profit was 32.1 bln. CHF, of which 24.6 billion came from gold.

Read More »

Read More »

Our Detailed Estimate of SNB Q2 Results: 17 Billion Francs Loss, The Reality 18 Billion

UPDATE: July 30th, 2013: Our estimate for the quarterly loss missed the reality by 1 billion francs. The quarter results: 18.3 billion francs loss. The loss for H1 was 7.3 billion CHF. July 1st 2013: We estimate that the Swiss National Bank (SNB) obtained a loss of 17.3 billion francs in the second quarter 2013. … Continue reading »

Read More »

Read More »

“SNB Concerned”: Does a Yes to the Swiss Gold Referendum Imply an End of the CHF Cap?

If the upcoming referendum "Save our Swiss gold" wins, the SNB must increase gold holdings from 10% to 20% of its balance sheet. Gold purchases and/or sales of fiat money implies an end of CHF cap.

Read More »

Read More »

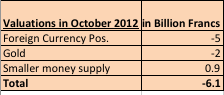

SNB Valuation Losses in October: Around 6 Billion Francs

The Swiss National Bank (SNB) had valuation losses of around 6 billion francs in October due to the weaker EUR/CHF exchange rate and a weaker gold price.

Read More »

Read More »

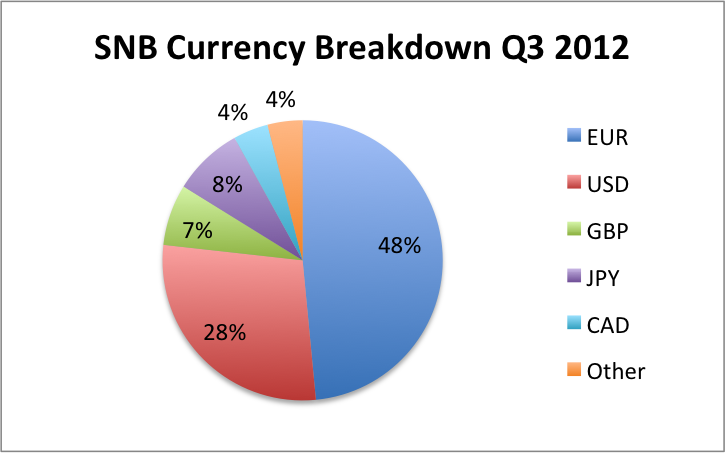

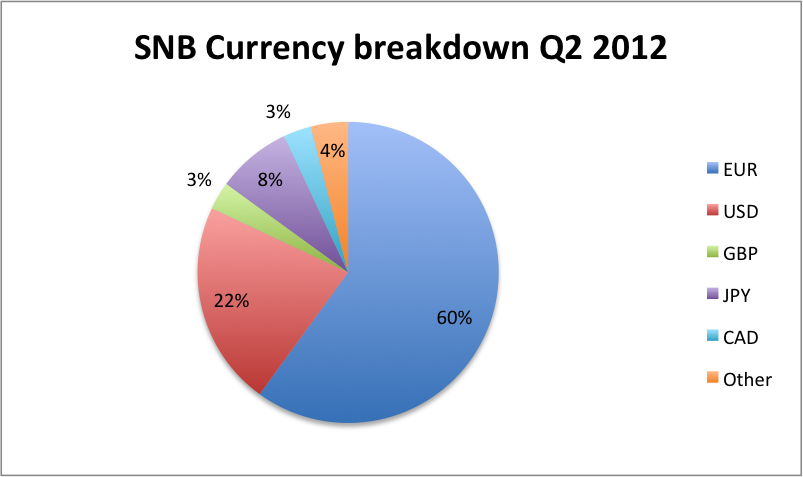

SNB Results Q3 2012: SNB Radically Reduces Euro Share from 60% to 48%

SNB Q3 Profits: 10 billion francs The Swiss National Bank (SNB) radically reduced its euro share, in the third quarter from 60% to 48%, and bought US dollars and sterling instead. In the second quarter, however, it increased the euro share from 51% to 60% and concentrated on buying euros. Given that the EUR/USD was … Continue reading...

Read More »

Read More »

IMF Data: SNB Forex Reserves and Gold in September 2012

This link on the SNB website shows the data the central bank provides to the International Monetary Fund (IMF). It shows the SNB Forex and gold reserves in the last month. It is so-called “IMF Special Data Dissemination Standard (SNB Data)” It is released together with the international investment position, some monetary aggregates and the balance of payments two weeks after …

Read More »

Read More »

SNB results: SNB invested 77% of the huge Q2 increase in reserves into Euros. Peg at risk ?

The Swiss National Bank (SNB) reported a profit of 6.5 billion Swiss Franc for the first half year (H1). After a loss of 1.7 bln. francs in the first quarter (Q1), it had a 8.2 billion profit for the second quarter (Q2). The Q2 SNB results of 8.2 bln. CHF were less than our … Continue reading »

Read More »

Read More »

SNB Results: SNB poised for 10 billion CHF quarterly profit

On July 31st the Swiss National Bank will publish interim results for the second quarter 2012. Already now we offer an estimate to our readers. Our estimate does not cover the central bank’s Forex trading results, they are difficult to estimate. A central bank is not a day trader, therefore the influence should be limited. …

Read More »

Read More »