Tag Archive: United Kingdom

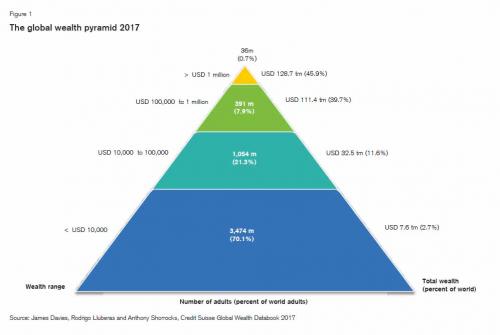

For The First Time Ever, The “1 percent” Own More Than Half The World’s Wealth: The Stunning Chart

Today Credit Suisse released its latest annual global wealth report, which traditionally lays out what has become the single biggest reason for the recent "anti-establishment" revulsion: an unprecedented concentration of wealth among a handful of people, as shown in Swiss bank's infamous global wealth pyramid, an arrangement which as observed by the "shocking" political backlash of the past year, suggests that the lower 'levels' of the pyramid are...

Read More »

Read More »

“This Is A Crisis Greater Than Any Government Can Handle”: The $400 Trillion Global Retirement Gap

Today we’ll continue to size up the bull market in governmental promises. As we do so, keep an old trader’s slogan in mind: “That which cannot go on forever, won’t.” Or we could say it differently: An unsustainable trend must eventually stop. Lately I have focused on the trend in US public pension funds, many of which are woefully underfunded and will never be able to pay workers the promised benefits, at least without dumping a huge and unwelcome...

Read More »

Read More »

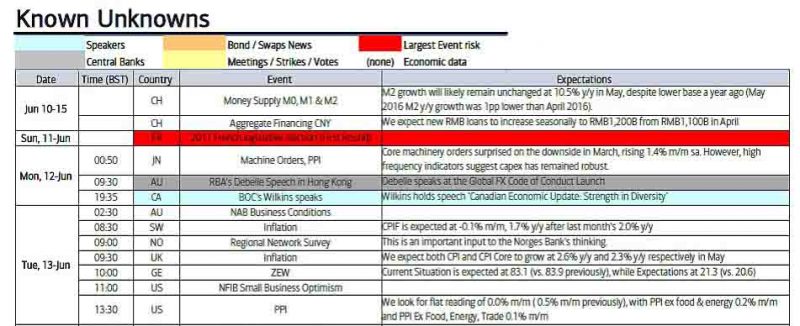

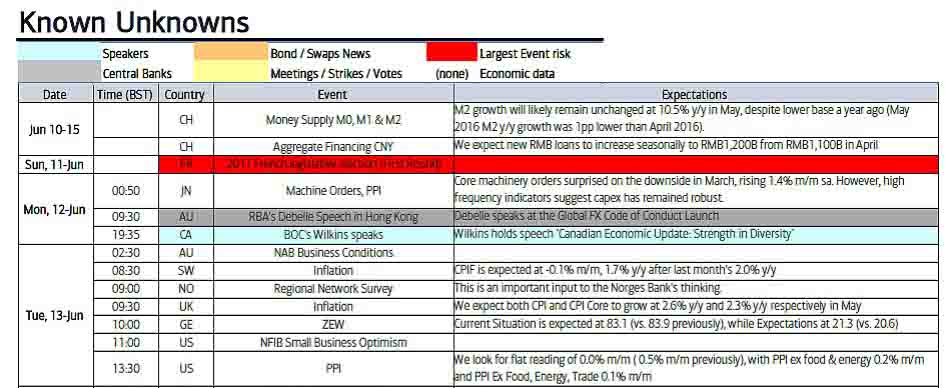

Key Events In The Coming Busy Week: Fed, BOJ, BOE, SNB, US Inflation And Retail Sales

After a tumultous week in the world of politics, with non-stop Trump drama in the US, a disastrous for Theresa May general election in the UK, and pro-establishment results in France and Italy, this is shaping up as another busy week ahead with multiple CB meetings, a full data calendar and even another important Eurogroup meeting for Greece.

Read More »

Read More »

Life Expectancy Indicates A Nation’s Overall Well Being – So Why Is America’s Dropping?

‘Exceptional’ America is seriously lagging behind in global life expectancy… Via: MesoTreatmentCenters.org Some additional details… Life Expectancy Indicates a Country’s Overall Well Being—So Why Is Ours Dropping? The last time U.S. life expectancy declined at birth 1992-1993: 75.8 to 75.5 years Resulting from high death rates from AIDS, flu epidemic, homicide, and accidental deaths After … Continue reading »

Read More »

Read More »

Nomi Prins’ Political-Financial Road Map For 2017

As tumultuous as last year was from a global political perspective on the back of a rocky start market-wise, 2017 will be much more so. The central bank subsidization of the financial system (especially in the US and Europe) that began with the Fed invoking zero interest rate policy in 2008, gave way to international distrust of the enabling status quo that unfolded in different ways across the planet.

Read More »

Read More »

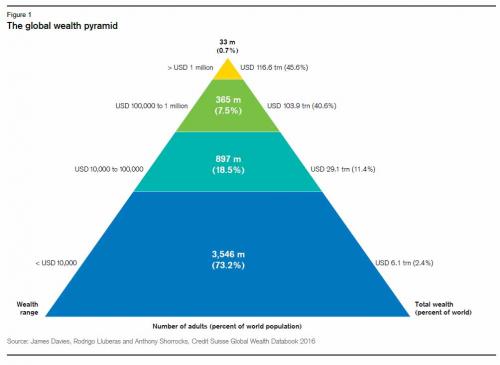

Global Wealth Update: 0.7 percent Of Adults Control $116.6 Trillion In Wealth

Today Credit Suisse released its latest annual global wealth report, which traditionally lays out what is perhaps the biggest reason for the recent "anti-establishment" revulsion: an unprecedented concentration of wealth among a handful of people, as shown in its infamous global wealth pyramid, an arrangement which as observed by the "shocking" political backlash of the past few months suggests that the lower 'levels' of the pyramid are...

Read More »

Read More »

Negative Rates and The War On Cash, Part 1: “There Is Nowhere To Go But Down”

As momentum builds in the developing deflationary spiral, we are seeing increasingly desperate measures to keep the global credit ponzi scheme from its inevitable conclusion. Credit bubbles are dynamic — they must grow continually or implode — hence they require ever more money to be lent into existence.

Read More »

Read More »

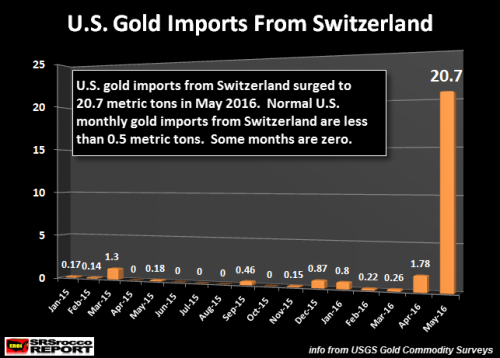

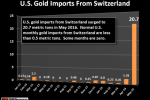

Record Swiss Gold Flow Into The United States

Record Swiss Gold Flow Into The United States. There was a huge trend change in U.S. gold investment in May. Something quite extraordinary took place which hasn’t happened for several decades. While Switzerland has been a major source of U.S. gold exports for many years, the tables turned in May as the Swiss exported a record amount of gold to the United States.

Read More »

Read More »

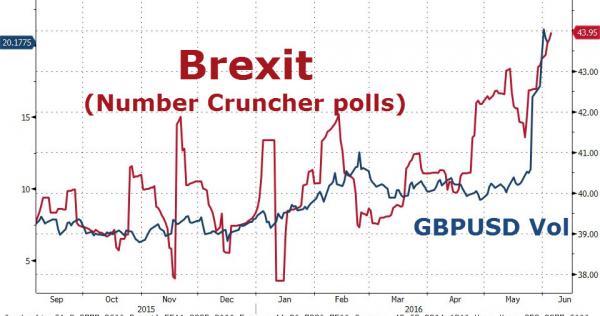

Great Graphic: What are UK Equities Doing?

Domestic-oriented UK companies have been marked down. The outperformance by UK's global companies is a negative view of sterling. The drop in interest rates is in anticipation of a recession and easier BOE policy.

Read More »

Read More »

Central Banks & Governments and their gold coin holdings

While this is true in some cases, it is not the fully story because many central banks and governments, such as the US, France, Italy, Switzerland, the UK and Venezuela, all hold an element of gold bullion coins as part of their official monetary gold reserves.

Read More »

Read More »

Another Strong Jobs Report may Not be Sufficient to Reignite Dollar Rally

The die is cast. The Federal Reserve is on an extended pause after the rate hike last December. The market remains convinced that the risk of a June hike are negligible (~ less than 12% chance). The ECB has yet to implement the TLTRO and cor...

Read More »

Read More »

Anticipation of Osborne’s Budget Weighs on Sterling

If UK Chancellor of the Exchequer Osborne wants to position himself to be the next Prime Minister, the budget to be unveiled tomorrow may not be particularly helpful. There is little room to relax fiscal policy, given the self-imposed constraints. The deficit for the current fiscal year was projected to be GBP73.5 bln, but through …

Read More »

Read More »

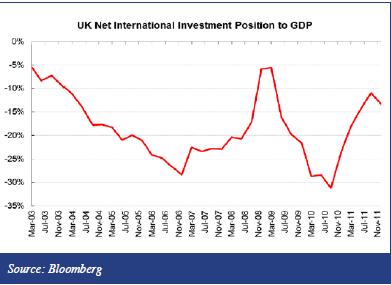

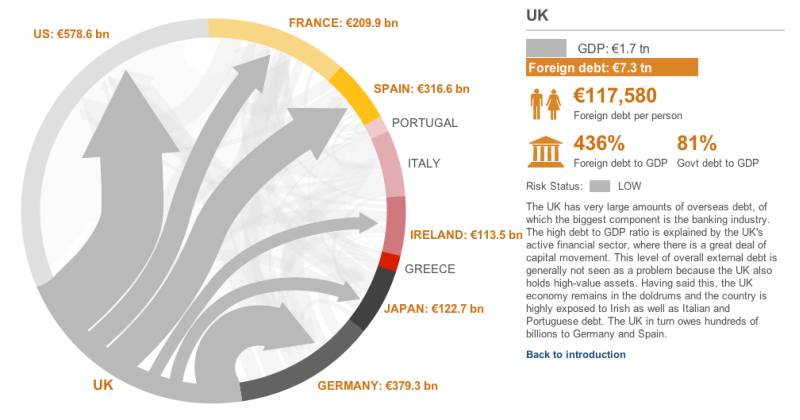

Who’s the Next Downgrade Domino to Fall?…The UK?

Who Downgrades France MUST downgrade the UK, too After Moody’s downgraded France, we are waiting the next major sovereign to suffer the same fate. According to the must-read interactive graph on the BBC, France now has a medium risk of default, but the UK is still in risk status “low”. According to the BBC, each citizen …

Read More »

Read More »