Tag Archive: United States

Aussie Sells Off After RBA Hikes 50 bp while Sterling Bounces on UK New Initiative

Overview: A GBP130 bln initiative by the new UK government to protect households from the surge in power costs helped lift sterling from 2.5-year lows. The Reserve Bank of Australia delivered the expected 50 bp rate hike, but the prospect of smaller moves going forward saw the Australian dollar sold through yesterday’s lows.

Read More »

Read More »

Week Ahead: More Evidence US Consumption and Output are Expanding, and RBNZ and Norges Bank to Hike

After two-quarters of contraction, many still do not accept that the US economy is in a recession. Federal Reserve officials have pushed against it, as has Treasury Secretary Yellen. The nearly 530k rise in July nonfarm rolls, more than twice the median forecast in Bloomberg's survey, and a new cyclical low in unemployment (3.5%) lent credibility to their arguments. If Q3 data point to a growing economy, additional support will likely be...

Read More »

Read More »

The Dollar Remains Bid, while Sterling Shrugs Off Johnson’s Political Woes

Overview: The dollar jumped yesterday making new highs against most of the major currencies, including the euro, sterling, the dollar-bloc and the Scandis. The yen and Swiss franc held in better, but the greenback still closed firmly against the yen despite a six-basis point decline in the 10-year yield.

Read More »

Read More »

FX Weekly Preview: Economic Data in the Holiday-Shortened Week

The capital markets will turn increasingly quiet in the week ahead as the Christmas holiday thins participation. If this is the season of goodwill, investors are lapping it up. Global equity markets are finishing a strong year on a high note. Record highs were recorded in the S&P 500 and the Dow Jones Stoxx 600. The MSCI Emerging Markets equity index is at its best level since August 2018.

Read More »

Read More »

Is The Negativity Overdone?

Give stimulus a chance, that’s the theme being set up for this week. After relentless buying across global bond markets distorting curves, upsetting politicians and the public alike, central bankers have responded en masse. There were more rate cuts around the world in August than there had been at any point since 2009.

Read More »

Read More »

FX Weekly Preview: The Green Shoots of Spring

Investors have worked themselves into a lather. Equities crashed in Q4 last year amid on corporate earnings and concerns about growth. The Fed’s tightening decision in December was made unanimously. The above-trend growth, the preferred inflation measure was near target, unemployment was the lowest in a generation and real rates were historically low.

Read More »

Read More »

FX Weekly Preview: Little Resolution in the Week Ahead

According to legend, the person who unraveled the Gordian Knot would rule the world. No one succeeded until Alexandar the Great took his mighty sword and sliced the knot in half. A young boy saw him afterward, crying on the steps of the Temple of Apollo. "Why are you crying?" the boy asked, "you just conquered the world. "Yes'" Alexander wept, " now there is nothing else for me to do."

Read More »

Read More »

Emerging Markets: What Changed

US-China trade tensions are rising. Pakistan devalued the rupee for a third time since December. Bulgaria will seek to join the eurozone banking union and ERM-2 simultaneously. The National Bank of Hungary appears to have tilted more hawkish. Newly elected Egyptian President El-Sisi shuffled his cabinet. Argentina has a new central bank chief after Federico Sturzenegger resigned.

Read More »

Read More »

Emerging Markets: What Changed

Reserve Bank of India cut its inflation forecast for the first half of FY2018/19 to 4.7-5.1%. Former South Korean President Park was sentenced to 24 years in prison. Malaysia Prime Minister Razak has called for early elections. Bahrain discovered its biggest oil field since it started producing crude in 1932. Local press reports Turkey’s Deputy Prime Minister Simsek tendered his resignation.

Read More »

Read More »

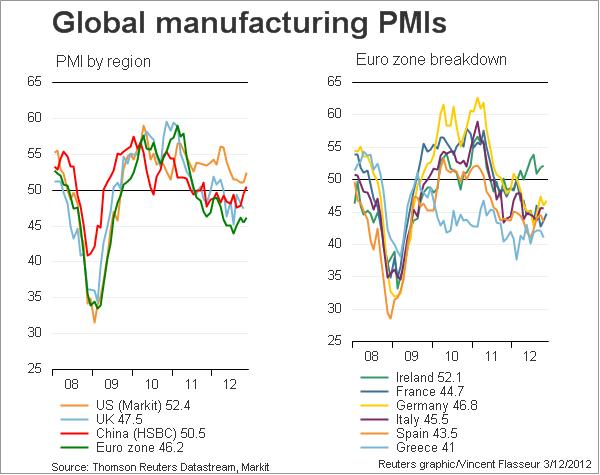

The Dismal Boom

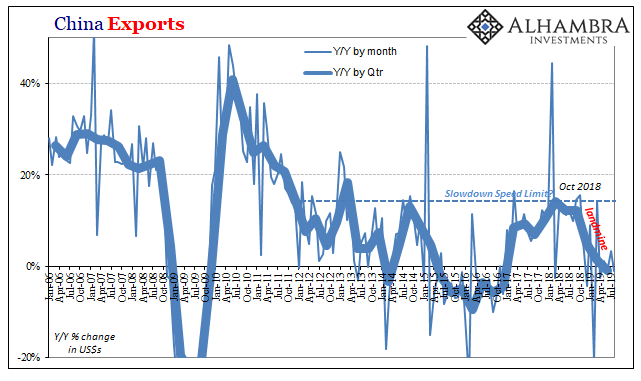

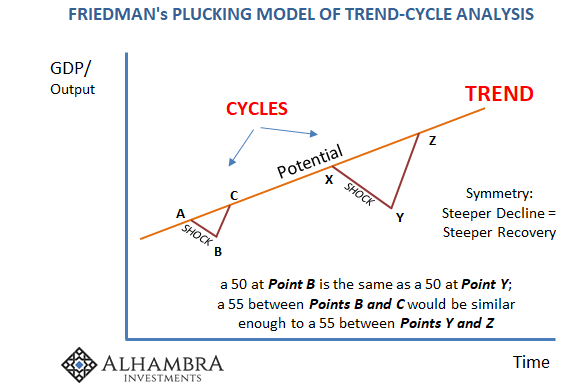

There is a fundamental assumption behind any purchasing manager index, or PMI. These are often but not always normalized to the number 50. That’s done simply for comparison purposes and the ease of understanding in the general public. That level at least in the literature and in theory is supposed to easily and clearly define the difference between growth and contraction.

Read More »

Read More »

Trump: Unilateralism or Isolationism?

Many who think that the US is becoming isolationist are wrong. The thrust is now more about unilateralism. Unilateralism can lead to the US being more isolated.

Read More »

Read More »

The War On Cash Is Happening Faster Than We Could Have Imagined

It’s happening faster than we could have ever imagined. Every time we turn around, it seems, there’s another major assault in the War on Cash. India is the most notable recent example– the embarrassing debacle a few weeks ago in which the government, overnight, “demonetized” its two largest denominations of cash, leaving an entire nation in chaos.

Read More »

Read More »

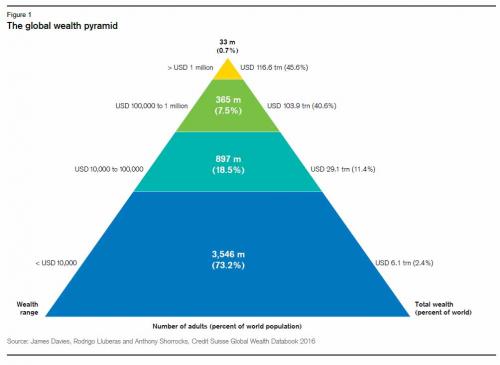

Global Wealth Update: 0.7 percent Of Adults Control $116.6 Trillion In Wealth

Today Credit Suisse released its latest annual global wealth report, which traditionally lays out what is perhaps the biggest reason for the recent "anti-establishment" revulsion: an unprecedented concentration of wealth among a handful of people, as shown in its infamous global wealth pyramid, an arrangement which as observed by the "shocking" political backlash of the past few months suggests that the lower 'levels' of the pyramid are...

Read More »

Read More »

US Election Infographic

This infographic was in the Wall Street Journal on the US election. It is important to remember that the US does not elect the President by direct popular vote. This makes the national polls a bit misleading. There are 538 electoral college votes. To be elected a candidate must secure a majority or 270 electoral … Continue reading...

Read More »

Read More »

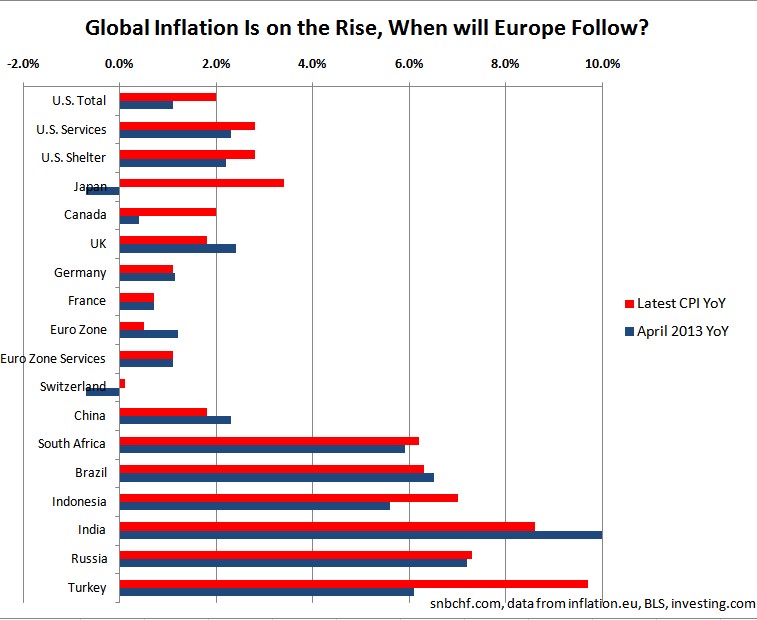

(2.3) Differences in global CPI baskets

Typically poorer countries have a basket with a higher weight for food and other consumption goods, but richer states give them a smaller weight. Here the full details over different countries

Read More »

Read More »

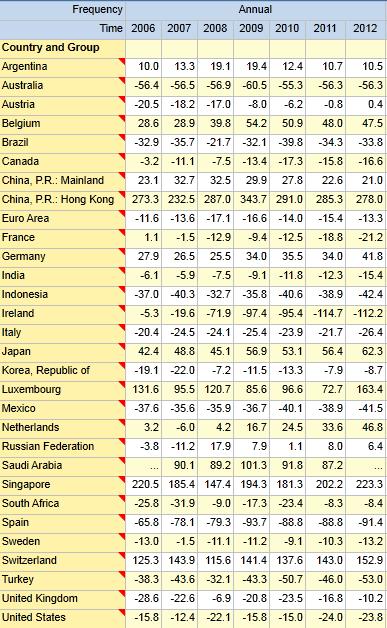

(9) FX Theory: Wealth and Net International Investment Position

Availability of funds (wealth and the international investment position): One of the 5 key indicators for FX rates. Often currencies of countries with a a lot of funds appreciate when markets decline.

Read More »

Read More »

(9.1) Net International Investment Position

A comparison of the net international investment position (NIIP) of several countries. We explain why asset valuation effects this position at the example of the United States.

Read More »

Read More »

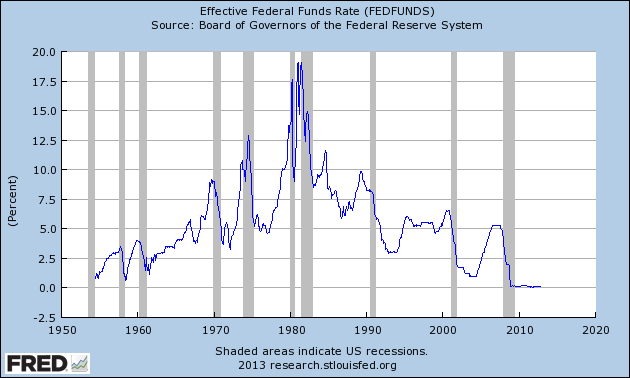

Quantitative Easing, its Indicators and the Swiss Franc

The main drivers of demand for Swiss francs are the euro crisis and, even more, the behavior of American investors, who go out of the dollar in the fear of bad US economic data and/or Quantitative Easing (QE). Risk-friendly investors move into risky assets like stocks or currencies of emerging markets, while risk-averse investors fear inflation and buy inflation-resistant assets like Swiss francs.

Read More »

Read More »

Net National Savings, Part two: The Consumption-Driven Economies

The second part on Net National Savings in % of gross national income, our preferred alternative indicator to GDP. This part contains the consumption-driven economies, which are Latin America and our Western countries

Read More »

Read More »